Day 2 of Blognado is upon us (or upon me anyway, I’m never sure where your day boundaries are relative to mine), so to keep people interested I thought I’d discuss something light and easily relocatable like the intricacies of tax policy.

Now I’ve done one post on taxes before, but that post wasn’t about tax policy per se. As far as I’m concerned “how much tax revenue should we collect?” isn’t a valid question. You answered that question when you set the government’s budget (and determined your fiscal policy settings if you’re doing the Keynesian thing). So for me the magnitude of taxes is a fiscal policy issue, not a tax policy issue. Tax policy is about how you raise the tax revenue you need: what gets taxed, how progressive rates should be and what breaks or exemptions will be permitted. In this post I’m going to outline how I think tax policy should be run generally and what implications that has for the US.

Terminology

Before I wade into the details, I want to define a couple of terms that are important to this type of policy. There are the names I’m familiar with, though you may have other terms you use for similar concepts.

Tax Rates: There are two tax rates any person faces, and each matters for different reasons. The most obvious one is your average tax rate, which is what % of your income you pay in taxes. This reflects the effect taxation has on your standard of living. It’s also the most useful rate to use when examining how progressive or regressive a tax is. Your marginal tax rate also matters, but for different reasons. Your marginal tax rate is calculated as the % of your next dollar of income that is taken as taxes. If your income increased by $1, how many cents richer would you be after tax? This rates reflects the effect of taxation on your incentives to earn more income, which is why it’s the rate economists care most about. The negative economic effects of taxes are caused by high marginal tax rates more than high average tax rates.

Purpose of Taxation: There are two main reasons why governments tax. The first is to raise revenue, which is what I’m talking about in this post. Government’s don’t tax income because they think people are pathological workaholics who need to be encouraged to take it easy, the do it because they need cash. The goal with revenue taxation is to change behaviour as little as possible while collecting as much revenue as possible. Those goals are in tensions, as I’ll explain later. The other sort of taxation is pigouvian taxation where you’re trying to correct a failure in the market by discouraging an activity. The goals in pigouvian taxation are reversed from revenue taxation, the goal is change behaviour and any money raised is incidental.

Incidence of Taxation: The incidence of taxation is who actually ends up paying a tax, as opposed to the person or party the tax is officially levied against. For example, corporate taxes could be paid in three ways: the shareholders could accept lower dividends (in which case the owners are bearing the incidence), the company’s employees could end up receiving lower wages over time (this would be the workers bearing the incidence), or the corporation could raise prices (the consumers are bearing the incidence). How much of each happens will depend on how the labour, goods and financial markets react to prices changes. Incidence is very important when considering how progressive a tax really is. If a corporate tax ends up being paid by workers and consumers it’s probably not as progressive as it might appear.

Principles

When designing an ideal tax system the first thing you want emphasize is neutrality. Neutrality is ensuring that your tax changes people’s behaviour as little as possible. In the absence of a market failure any change you make to people’s behaviour is impairing allocative efficiency, and so you should do as little of it as possible. Practical tips for neutral taxation include:

Use taxes that are hard to avoid. Capitation taxes (i.e. tax everyone $X) are the best for this since you have to be really dedicated to Going Galt in order to commit suicide just to avoid paying taxes. Of course capitation taxes are problematic for other reasons (I’ll talk about progressivity below), so other good choices are income taxes, consumption taxes and capital value taxes. Of these land taxes are the best because the incidence of the tax falls entirely on people who owned land at the time the tax is implemented, making avoidance effectively impossible. But you don’t want to jack the rates on any one tax too high as that gives the tax accountants too much of an incentive to start finding loopholes (and works to not work quite so hard), so the ideal tax regime will consist of several taxes each with modest rates (how modest depends on your budget of course). Note also that the more complex your tax system is (with multiple rates, deductions and so on) the less neutral it will tend to be.

The second principle is progressivity, which is how the burden of the tax falls on the poor vs. the rich. Now how progressive taxes should be is a subjective question, so I won’t take a position on this while I have my policy hat on, though I will say that at regressivity should probably be avoided. When it comes to measuring the progressivity of a tax I recommend using average rates and not marginal (though check to make sure welfare isn’t making marginal rates too high for the poor or you’ll create a poverty trap), account for the incidence of the tax as well as you can and don’t forget to net welfare spending out of the average tax rate so you can compare the net effect of government on the poor vs. the rich.

The third principle is the laffer curve. Now the laffer curve is one of those subjects where a lot of nonsense gets written, so here’s the short version from someone who’s actually: yes taxation does experience diminishing returns, even to the point where revenue falls as marginal tax rates rise. But that revenue-maximising rate might be very high and it’s almost certainly not in the 30-40% range. However, that doesn’t mean the laffer curve doesn’t matter. For one thing the diminishing returns will feature all all points of the curve so you can’t expect a 10% increase in average tax rates to yield at 10% increase in revenue. Secondly, different revenue sources have different laffer curves. The reason most countries tax capital gains less sharply than other sources of income is that it’s much easier to hide your capital overseas than it is to move overseas yourself. That ease of avoidance makes taxing capital gains trickier than taxing other income. Third, the shape of the laffer curve is affected by policy. The simpler your tax system is, the more neutral the taxes are and the less corrupt the tax collection mechanism is the more revenue you can extract without diminishing returns causing you a problem. Finally, at some point you’re going to hit that laffer peak, and even before tax rates get that high, they can take a significant toll on economic performance. A government can noly be so big, given the siz eof the economy and it’s worth bearing that in mind, even if the limits are more expansive than some would suggest.

Advice for the US

So how does all of this translate into US tax policy? Here are some areas I’d suggest as good starting places for tax reform:

1: Simplify!

The key to a better-functioning tax system is to tax many activities a little, instead of a few activities a lot. That means clearing away exemptions, deductions, tax breaks and other fiscal bric-a-brac as much as possible. That allows for lower marginal tax rates without affecting average rates, in fact you can even end up with more revenue than you had before. Those deductions might look good one at a time, but taken together they render your tax system unmanageable. Think of all those tax accountants who will be freed up to apply their intellects to more positive-sum activities.

2: Take a second look at corporate taxes

The general opinion is that corporate taxes are paid by the 1% for the benefit of the 99%, but I think that assumption merits testing. I’d like to see some research done on the actual incidence of corporate taxes, and whether it actually makes sense to tax corporations at all. Corporate taxes add a lot of complexity to the tax code, and if that can be avoided I think it’s worth investigating.

3: What does “no tax increases” actually mean?

Many conservatives in the US, the Tea Party in particular, have stated strong opposition to tax increases. But what does that mean in practice? Is your opposition to higher marginal rates? If so, how do you feel about simplifying the tax system which will lower marginal rates even while raising revenue? Do you oppose average rate increases? If that’s the case I hope you have a brilliant plan to cut spending. The answer will be different for everyone, all I ask is that you figure out exactly what you will and will not support, and then state it clearly so any opportunities for cooperation can be identified. Because something has to change, and the sooner the changes begin the easier things will be for everyone.

This post is enormously awesome.Report

Thanks Patrick, glad you liked it.Report

I wanna Echo Pat, this is great, especially the callout regarding corporate taxes.Report

Not to pile on or anything, but that was a tremendously useful introduction to taxing issues. Thank you!Report

Just a few thoughts, nothing organized:

Progressive taxes mean people don’t save and by extension don’t invest their post-tax earnings. Clever people simply get a better tax and investment guy to shelter their income. It’s a fine art and costs people loads of money but it’s worth every penny. The rich don’t spend: they invest. The poor spend everything because they don’t know any better.

The 401(k) model has addressed some of the deficiencies of progressive taxation for Joe Sixpack but not by much. Most people don’t have the sense to max their 401(k), believing (usually correctly) they’re not going to recognize any benefits until they’re too old and gouty to enjoy them.

Moreover, the longer I think about i, I’ve come to believe progressive taxation looks great on paper but the USA’s implementation is stupid. Even though I am a big ol’ Liberal I’ve looked at the math and soaking the rich is political popcorn: mighty tasty when it’s fresh out of the popper. Not much nutrition in there, just starch and grease and salt. Folks just will eat it up but it makes a lousy meal. Attempting to soak the rich is a mug’s game: they can shelter their income faster than you can pass laws to get at it. I’m not averse to progressive taxation but consumption is a far more accurate gauge of taxable income than income.

The income tax is mostly stupid. The AMT is a nightmare which ought to be repealed tomorrow: it might have made sense but many of the loopholes it was designed to address have long been closed. We know what people earn and we have even better data on what they spend: put that data through a CBO-type model, applying income and consumption data to create a tax model which would encourage investment and the formation of corporations, hunting for a Goldilocks Zone where taxes wouldn’t crush down the economy.

Congress would be obliged to create budgets on the basis of these models. No more of this Soak the Rich from the Liberals and harum-scarum about Welfare Mamas from the Conservatives. Politicians could play with the model but economists would engineer it.

The cogent observer will have already noticed the glaring deficiency in this scheme: Congress makes tax law and each Congress-critter thinks only of his state. The larger scheme of things is always ignored in this process. I see no good way around this short of a new constitution.Report

Ugh. Let’s try that again

<i>I’m not averse to progressive taxation but consumption is a far more accurate gauge for taxation than declared income.</i>Report

I must disagree, and I don’t see how consumption could be a more accurate gauge for taxation than declared income if “the rich don’t spend, they invest.” For quite a while I’ve felt that we should tax only personal income and not consumption, and I’ve toyed with the idea that we should not tax corporations except to price in negative externalities. We should have a progressive income tax structure with many more brackets. When we reduce tax rates, we should reduce them at the lower brackets first. We should eliminate all tax deductions; when we want to encourage consumption of something like higher education or homes we should subsidize to increase supply and/or reduce price.Report

In principle, you’re correct. Consider this: taxable income has become something of a fiction. Not the actual earned income, that much we know, but after all the deductions and income hiding, what’s left?

Consumption, however, shows how much of my income actually moves through the economy. I’m not sure we can call it Pigouvian, this business of trying to pushing income into investment rather than consumption, but taxing consumption would tend to increase investment. Let the last

Stepwise functions are a mess. The more steps, the worse they get. Beyond the obvious conclusions about consumption and investments, I have serious ethical reservations about progressive taxes. They’re unequal to their core and the steeper the slope, the greater the propensity to avoid them. They are, as I have said, political popcorn: it’s class warfare at its most repulsive: the truly wealthy hide behind corporations anyway.Report

Ugh. Gotta go back to composing outside this wretched JavaScript box.

EDIT: Let the last … half century show what happened when we became a consumer society and not an investor society.Report

It’s true that one’s level of consumption shows how much of your money is pumping through the system, but that’s also true of useful investment. Money that’s invested in productivity is money that’s spent either on resources or labor. But there’s also a lot of investment that’s not spent. Money that’s invested in stocks, unless it’s into an IPO, is not spent on productivity. And the incentive to invest in financial instruments is to gain a return purely in money terms, not to increase production or productivity.

Currently there’s a global glut of savings. This is why the U.S. monetary base could be increased something like three-fold over the past few years without driving up interest rates on U.S. Treasury debt. There’s all this money out there that can’t find productive investments that seem worth their risks. So this money gets invested into an entire safe economy (which is what purchasing Treasury debt is like) which can’t save money for the future because there’s no point in that. Money that the government collects that it doesn’t spend is just money that’s not doing money’s job, which is to circulate facilitating transactions — that is, a sovereign government surplus that’s not spent is effectively a reduction in the money supply.

The analogy is to blood. Blood that’s not circulating isn’t doing its work. It’s as if it were just going into an ever growing blood blister. What’s really needed is for the blood to be delivered to where it’s needed now, and whatever’s not needed now needs to be drained and more created later when it’s needed.

We like to say that we’ve gone from being an investment society to a consumption society, but how can that be genuinely true when the finance sector of the economy has grown so much relative the rest of the economy?

FYI, I’m not an economist and these are just my impressions. There may be — perhaps probably are — ways in which what I’m saying can be shown to be clearly wrong-headed, and I’d appreciate having those pointed out.Report

Well, I’m just a model builder. I’m not a full-fledged economist yet. This I do know about economics: it’s rather like weather forecasting. Some models work better at different time ranges and in different circumstances.

You make a cogent observation about the glut of cash on the sidelines. What might bring that money back into the market and where would it go if it did? I contend much of that reticence resolves to investor confidence, directly related to the predictability of taxation. Look at the Congress’ continued fecklessness, playing games with the budget process. I’m not pointing fingers here, I’m analyzing why investors like me continue to hang onto gold, though I’m slowly easing out of that position.

I’m a Fear Investor: I’m motivated by stupidity and take advantage of panicky herds of short term investors. I look to buy stocks in companies with sound earnings with a low P/E ratio. Dead simple investment strategy, but since I can’t get a clear picture of this constipated market, I’m loth to invest. My only guide is to look at how closely earnings match the stock price.

I’m supremely uninterested in anything but market fundamentals. Insofar as it’s a good company with good earnings, it’s a good place to make money over the long haul. Corporations with good sense invest in themselves, retooling, building new factories, building new products, funding their R&D. I don’t like to invest in any corporation which doesn’t have an R&D division. Tells me they’re thinking long term.

The finance industry, especially the joint stock corporation, is the main reason the West has prospered so mightily where other systems have failed. It’s compatible with every sort of political system save Communism.Report

Well, BP, I ain’t investing strictly because the SEC is a POS unreliable and undependable organization. When the market’s tight, and all the sharks are out, smart little fishies go hide.Report

The SEC Club features a revolving door at the front. Within its confines, the regulators and regulated slither about in a grotesque pile of greased, naked bodies.Report

don’t forget the p0rn.Report

“Gatsby believed in the green light, the orgiastic future that year by year recedes before us. It eluded us then, but that’s no matter — tomorrow we will run faster, stretch out our arms farther . . . And one fine morning—-”

Is it not so much a matter of adjusting what we’re after?Report

F Scott Fitzgerald was a damned poor guide to his era. A sot, a spendthrift and an genial idiot. His greatest hero, Gatsby, was a two bit bootlegger in pursuit of the unattainable. What we’re “after” is usually an illusion.

Though lots of folks mock the equivalence of a person to a corporation, the parallels are pretty good in terms of what we want from both. I would extend the metaphor to the state except our nation exhibits schizophrenic and self-delusional tendencies beyond the current Constitution’s powers to correct.

At no point has this country ever considered the financial well-being of its citizens a priority, beyond some interesting experiments in the time of FDR, most of which blew up in FDR’s face. FDR inoculated the USA with a dose of socialism in an attempt to save a very sick patient. FDR made significant and important reforms to banking and securities markets, most of which were good for the system. Since then, the nation only saw fit to pull down his reforms, especially Glass-Steagall, which probably did need some changes but not outright repeal. Well, 2008 came along and trillions of dollars were ejected into the void.

Here we are in Anno Domini 2012 and the economy is still hung over. We’ve bailed out the banks and suchlike. Arguably these institutions were too big to fail. But consider an alternate universe in which the government invested in its citizens, looking to create more taxpayers and devising schemes to that end?Report

I don’t know; those shortcomings would seem to make him a terrific guide to the experience of his generation. The disabledest man in a disabled time.

That’s very much the point here though, isn’t it? We reduced tax rates on upper tiers of income because it was thought that it was both unfair to take so much of what the rich had “earned” and because it was thought that the self-interest of the rich would cause them to apply all that newly un-taxed income in ways that would end up being a net positive for society as a whole. I don’t feel either is true. I think some reality tv shows, much as I detest the form myself, has exposed anew the emptiness of competitive leisure and luxury, and the economic outcomes are there for all to see as you point out.

You said above that progressive taxation causes people not to save but to shelter their income. I’m not sure that’s entirely true. And private savings sufficient to support a large retired class is an impossibility because it would end up being all this money just sitting there as a huge proportion of all money just competing with itself. I think that’s why it made sense back in the ’80s to set up a Social Security trust fund that held government debt and bet that the government using that money now and paying it back later would mean an economy growing fast enough to pay it back later.

To create more tax payers paying more tax would mean more tax payers earning more to be taxed, so the system can’t be designed to keep the money flowing upward and mostly staying there. But the incentive for promoting a more redistributive or circulative system has to come from our sense of what’s good in life. Excessive wealth or perhaps excessive opulence might need to be stigmatized a little more. Paying rock stars to play your birthday party should be a little shameful and finding rock stars singing songs in your salon because they like you should be preferable.Report

You make a cogent observation about the glut of cash on the sidelines. What might bring that money back into the market and where would it go if it did?

Well, in theory, inflation. The problem, though, as you allude. is it just may simply drive all the big money into (yet another) speculative bubble, and, in any event, really screws over the small money.Report

Libertarians make this point about Bubbles. Trouble is, they think deregulation will solve the problem when the exact reverse is true. China’s waist deep in speculative bubbles and crony capitalism and no good will come of it. As varies risk, so varies the need for regulation and truly open markets, where bets are paid and winners can be separated from losers and the regulated are separated from the regulators.

The Invisible Hand always seems to be attached to an arm with a hidden ace up its sleeve. Big money moves small money: watch and listen as someone big steps up to the top tier in the Corn pit to trade a hundred lot and you’ll get my drift here. Big Money won’t move unless markets exhibit stability. The Wall Street Weasels ought to be regulated within an inch of their lives so they don’t welch on their bets. That regulation is the sovereign cure for the Bubble Phenomenon.Report

Couldn’t agree more.Report

There’s a difference between ending Prohibition on the one hand and actively providing the beer bong and case of Milwaukee’s Best Light on the other.

Report

Plus the issue of regulation being sufficient to prevent bubbles is a different subject than simply the efficacy to put the gas on the velocity of money and get it going where you want it to go to fulfill your policy ends.Report

Unfortunately everything we understand about bubbles suggest there simply is no preventing them, whether by regulatory or deregulatory means.Report

Well government policy sometimes exacerbates bubbles; and if, at the very least, it stopped doing that, it would help.

Many people were begging Alan Greenspan to act against the real estate bubble (Barrron’s famously had an editorial urging him to up the discount rate because the low FED rates were clearly contributing to the accelerating inflation in the housing market which was feeding the bubble). Not only did he demur, he made a public statement urging people to buy more variable-rate mortgages.

I was working in the mortgage industry during the peak years of 2004 – 2005, and there were clearly about a million ways that the Federal Government could have ended or mitigated the housing bubble. It fed on fraud: here’s a partial list of policies that could have ended the party before we ended up in depressioin:

You are, of course, welcome to dismiss all these as counterfactual. But I would assert that there were many, many policy and regulatory options that could have prevented a great deal of the damage we are all suffering through right now.

When an investment or asset bubble grows to dominate the economy, we have an obligation to our own self-preservation to make sure that it doesn’t threaten the long term health of our financial and economic systems.

Report

Regarding class warfare, changes in progressive taxation is what we have instead of revolutions and suppressions (word?). That is, in my view this sort of class struggle is what we have instead of class warfare, in both directions.

Regarding the wealthy hiding behind corporations, that would have to protected against in the new tax legislation and other regulation. Besides, the wealth that lasts more than a couple of generations (old money) seems to be ownership of land and other long-lasting real stuff, not ownership of producing businesses.

Again, I’m a dilettante or ingenue here, so claim to be making these statements with authority and would appreciate corrective feedback.Report

Consider what might happen if we all “hid” behind corporations. Boy howdy, the government would sit up and take notice. At 20 minute intervals, we’d haul out some hapless Congressman and tie him to the nearest light pole and beat him bloody and shove him back into that august assembly as an example to the others, until they started doing the business of the nation.Report

Scaife? The Waltons? Koch? surely you’re joking…Report

C’mon. Anyone with money can play their game. Liberals have been entirely too reticent and squeamish to play it well, though some of us do. Note how the name of George Soros causes every reactionary idiot to break out in a rash of assholes.Report

Now that’s an image worthy of William Burroughs.Report

I must disagree, and I don’t see how consumption could be a more accurate gauge for taxation than declared income if “the rich don’t spend, they invest.”

That’s the argument for consumption taxes, not an argument against them. Money is just paper. Or bits. Either way, it’s not a real resource. You don’t derive any concrete benefit from your money unless and until you spend it, and you having money in your bank account that you’re not spending doesn’t make me any worse off. In fact, if you invest it, it makes me better off.

Suppose someone’s making a million dollars a year, and only spending $50,000. If he’s only consuming $50,000 a year in resources, then why should he be taxed on $1,000,000 worth? If he’s investing the rest of the money, why would we want to reduce the amount he has available to invest? That’s nuts. We shouldn’t tax him until he decides to spend it.

And if he never spends it? Then we’ll tax his heirs when they spend it. Or maybe he’ll give it away, in which case taxing him on that income really means taxing the charity it would have gone to.

Making money and not personally consuming it is one of the best things a person can do for society. We shouldn’t be taxing that.Report

The poor spend everything because they don’t know any better.

That depends how poor you mean, if someones income exactly equals their essential* living costs they’d be pretty stupid to save or invest when that leads to either doing without essentials or funding them with debt that is likely to at least equal and probably exceed the amount saved.

*There is a lot of wriggle room on what is an essential but unless nothing is I think my argument stands for at least some people.Report

How very right you are. The current system is so completely jiggered to the Consumer side few people see any benefit to becoming an Investor. He who puts his money in the bank is only benefiting the bank. The bank keeps just enough money around to satisfy withdrawal needs and can use the Federal Reserve system to that end: the rest is invested.

Here’s where we need to wriggle for our lives as taxpayers. The poor remain poor because they do not invest anything in their future. Money makes money, be the sums ever so small. Analyze the money flow problem: once the money’s in the bank, your bank balance is a numerical construct: it doesn’t stay in the bank. Plenty of poor people don’t even have bank accounts. That’s got to change.

There’s only one effective guide to taxation, imho: only tax money in motion. The poor end up paying tax far out of proportion to their income in profoundly regressive sales taxes. We see pathetically inadequate Pigouvian compensatory schemes at the grocery store, where some items are taxed and others aren’t. If people had any idea how much tax they actually pay, they’d head to Washington and demand reforms. But because these parasite taxes seem small, people put up with them.

Problem is, as I’ve said upstream, we need more sophisticated taxation models. I’m not sure what the ratio is anymore, but the law library at Sears featured about three times more statute law on taxation than criminal law. As any three tax preparers to do your return and you’ll get three different sets of results. The government ought to be run for the people and for their benefit. As James K notes above, there’s a distinct lack of transparency in taxation. Address that first.Report

… and I haven’t even begun to address the distorting effect of government subsidies.Report

“What does “no tax increases” actually mean?”

Grover Norquist’s oft-stated view — and Grover is defining the terms of the debate for a lot of conservatives — is that any change that results in increased revenue for the government is a tax increase. Stupidest tax deduction in existence? If eliminating it increases revenue, Grover says it’s a tax increase.Report

Grover Norquisling has managed to simultaneously betray both the Libertarians and the Conservatives. One or the other will eventually wise up to him, take him out behind the barn and cut his throat.Report

Great post. The other factor at work in the US that imo provides a nuance that isn’t included enough when discussing these things is that the various types of taxes (e.g. real estate, use/sales, income) all tend to be divided in their utilization by the level of government (local, state, federal).Report

Great summary, James

I would add that the other issue on the Laffer curve is that the optimal short term rate for revenue maximization may differ significantly from the long term rate. In other words, tax rates can affect growth rates that feed into the long term revenue base.

On your third point, I believe conservatives tend to believe that limiting tax collection forces austerity. If the government has it they will spend it, so the key to restricting unlimited increase in government interference in the economy is to restrict total receipts. Congress can spend a hundred billion with a single rider to a bill, so their thinking is we had better be sure they do not have it to spend.

Limiting revenues is their “brilliant plan to reduce spending”. Or at least to limit increased spending.Report

Yeah. Problem is, every bit of spending always seems urgent (to someone) and decoupling the need to spend from the need to raise needed revenues based on the idea that every bit of refused revenue guarantees greater revenue in the future is a recipe for burgeoning debt.Report

Yeah, it seems American democracy is a recipe for burgeoning debt and governmental largesse.Report

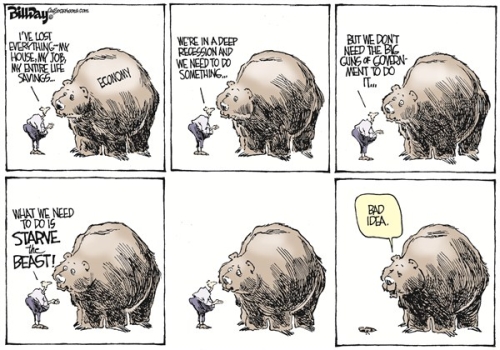

To your second point Roger, current historical evidence seems to be firmly in that “Starve the Beast” is an utter and colossal failure. Obsessing about keeping the tax rates down while (substantively) ignoring the spending side has only served to destroy the conservative greed eye shade type, decouple government bonbons from taxes in the minds of the voters (and thus increase support for them) and baloon deficits and national debt.Report

North,

An utter and colossal failure compared to what?Report

compared to its stated objectives?Report

Which were what? To reduce the growth of government? To say that failed we would have to know what would have happened absent such a program.Report

And that is pure sophistry. I’m surprised to see you deploying it.Report

Yes, I know that’s a common belief, but it doesn’t seem to have a good track record. The problem is that congress doesn’t have to actually have money in order to spend it. When a business starts borrowing too much, equity analysts get worried and it affected the value of the company’s shares. But there’s no equivalent for government, once voters have stopped equating taxes and spending. As we have seen a government unchecked by fiscal responsibility will just go on racking up debt until it hits its credit constraints. Then bad things happen.Report

James,

Again I ask the question, compared to what? I agree that democracy decouples spending and revenues. I understand that we spent it even though we did not have it. The question is how much more would we have spent if we had not tried to starve the beast. We do not know this.

I think conservatives believe we would have higher spending, more government waste and regulation, much higher taxes, slower growth, less wealth and the same deficits.Report

Conservatives might believe that, but if they do, it seems like willful ignorance to me.Report

Plinko, North & Liberty

All three of you seem to be parroting a left wing meme of some type. Starving the beast is a stupid and ineffective strategy.

To make your case you would need to understand the goals of conservatives and compare it to what they believe would have happened if they had another strategy.

Maybe you are right. Maybe it is willful ignorance on the behalf of tens of millions of people. You need to make your case first though. Let’s hear an actual argument rather than left wing Meme replication please. Care to try?Report

Well, I don’t have a magic counterfactual machine to prove anything, so you’ll have to bear with my guesswork.

The conservative contention (that ‘starve the beast’ is actually keeping things from getting worse!) requires us to believe one or both of two things:

1. If Congress had felt compelled to cover the cost of new programs with offsetting tax increases – that proportionately higher levels of spending would have been enacted over the course of the last three decades would have occurred than already did.

2. If the Bush-era income tax cuts had not occurred, that there was even more spending that Congress would have enacted but could not, for want of potential debt to issue.

I find the first one to be pretty unbelievable without a really, really different Congress in the counter factual – it would have been extremely easy, especially in the Senate, for everything to just die rather than be coupled with any kind of tax offset.

The second is kinda plausible but given the enormous spending spree of that same Congress I find it hard to imagine that any programs were out there that they would have enacted if only they had room to issue even more debt – maybe the Mars mission could have been scheduled way, way earlier?Report

Pinko,

Sorry I missed your comment before my last reply.

I think the vast majority of tea party folks believe that we would have found countless ways to spend more money. We could have added another trillion to get out of the recession, we could have added a few hundred billion more to Obamacare, added another Medicare giveaway and funded another few wars in the Mideast.Report

And I believe if only the refs had made the right call in that 2008 playoff game against the 49ers, the Packers would have gone on to win the Super Bowl.

That perspective is non-falsifiable, they can think it all they want but what good will it do anyone?Report

Roger, maybe I could compare it to conservative goals pre- starve the beast? As I understand it old school conservatives said “Lets cut spending by cutting spending (Gasp).

Starve the Beast said, in essence, “Cutting spending is hard. Let’s instead run up deficits and drive down revenues so that someone else is eventually forced to cut spending for us. Preferably someone who’s not us. Then we get the credit for cutting taxes and they get the blame for cutting spending. Genius! *chortle*chortle*prance*prance*.

So far, it looks like when you set out to cut spending and achieve that goal you end up with… reduced spending.

in comparison if you set out to starve the beast and achieve that you end up with… higher spending and larger deficits.

So, compared with the older conservative tactics of cutting spending I would submit that Starve the beast is a failure, and in that Starve the beast also seems to have pretty much destroyed the (credible) fiscal conservatism of one of the countries two major parties I’d assert additionally that it was a stupid colossal and destructive failure. At least from the point of view of a fiscal conservative (which I’m not exactly but as a fiscally conservative liberal I can think like one when I squint hard).Report

Starve The Beast is viable on a state level, but there is simply no reason to believe that it is viable on a national level. Not that conservatives don’t believe it. But I agree about Plinko about willful ignorance.Report

Will,

Details appreciated…..Report

States have to come within a reasonable proximity of a balanced budget. The federal government does not. So states which limit income, limit spending. The federal government can limit income and increase spending at the same time. And does.Report

How about these bits of evidence:

Report

Compared to how good it would need to be in order to restore fiscal balance. The problem here is not so much the level of spending, but rather the vector of spending. Spending is rising at an escalating rate and I don’t believe for a second cutting taxes will slow that rate of growth, particularly since most of the spending growth comes from entitlements which grow automatically.

It’s one thing to insist that any tax increases be accompanied by spending cuts, but to try and cut taxes in the current fiscal environment is madness.Report

James, Will, Snarky, North and Liberty,

You guys are all talking around the issue. The claim from the left is that starving the beast is stupid and useless act of self deception.

I think Tea Baggers are aware that the fed can deficit spend and that republican presidents are often as bad as democrats. I have heard them say as much.

To convince them that starving the beast is useless you would need to convince them that growth in government would not have been even worse absent their starvation diet. You guys are nowhere close to showing this.

Seriously, it just seems like you are all just dismissing their argument because you disagree with it. I am not saying I agree with them, but at least I take the argument as worth considering.Report

Roger,

Fair enough, but to make their argument persuasive you have to show that growth in government would have been even worse absent their starvation diet. You/they are nowhere close to showing this.

Each side needs an alternate reality machine to provide the missing data. The “starve the beasters” not one whit less than those who are skeptical of their claims.Report

Addendum, if the starvation hypothesis is to be given at least some benefit of the doubt, it ought to at least be able to show that the expenditures growth curve became less steep following significant tax cuts. I mean, we have had the independent variable, so we ought to be seeing some kind of positive correlation on the dependent variable, even if its weak.Report

James,

Maybe, but that would assume they are not logrolling short term tax reductions for increased spending.Report

Not quite following that, so feel free to haul me up short if I’m misinterpreting it, but wouldn’t that just be evidence against the argument? Any tax reductions that lead to increased spending would seem to contradict (not necessarily disprove) the hypothesis, no?Report

Any tax reductions that lead to increased spending would seem to contradict (not necessarily disprove) the hypothesis, no?

That’s an excellent point, James. If not, then the theory quickly becomes irrefutable, with all the a priori nonsense that follows: conspiracy theories, RINO, denial of evidence, ‘conservatism can only be failed’, first principles, etc etc.

But I’d go even further than you are here: it prima facie contradicts the theory, but it disproves it insofar as the theory requires human behavior to be different than it is, or institutional meta-structures to be different than they in fact are.Report

That’s always bugged me a little about the Laffer Curve.

The argument, even if true, strikes me as greasy.

“You people like the idea of the government making more money, right? You should like this idea, then!”Report

James and gang,

That is why I am not making their case. I am simply pushing back on a half dozen folks who are saying conservatives are self deluded idiots to embrace the dumbest idea of all time.

If the only way to prove either side is a time machine, perhaps we should not dismiss either side as misguided rubes.Report

Roger,

Again, they can at least show bending of the spending growth curve. If they can’t, they are indeed stupid and deluded, for lack of any evidence in support of their thesis.

There is also the problem of theory–politicians can benefit by providing goodies for their constituents for free, and charging non-consituents for them. Future voters are non-constituents. If anything, borrowing may increase the rate of spending more than tax increases, precisely because no current constituents feel the pain. Actually raising taxes to cover spending would seem to be a theoretically more sound way to starve the beast, because then the recipients of the goodies actually understand the consequences of getting them. I think starve-the-beasters haven’t thought this through from a public choice perspective very well.

The whole theory of starve the beast depends on lack of tax revenues being an actual constraint on politicians. I don’t see much evidence for that. The only plausible argument is the long-run one; not exactly starving the beast, but leading it into a Greek-style collapse, and hoping upon hope that the resulting changes are more to their liking.Report

As usual, Professor Hanley puts it much better than I could hope to.Report

James and all interested in Starving The Beast,

This is a fascinating topic. The left hates starving the beast (STB) because it is used as an excuse to avoid tax increases, which can be used to get the dangerous rich people and fund new ideas. Libertarians dislike it because it allows kicking the can down the road and not facing tough spending cuts. Some conservatives question it because short term effect is faster growth of government spending, as it avoids the pain. Bond markets hate it because it increases deficits and inevitably leads to a crisis showdown.

After digging into the topic, here is my feeble attempt at a summary…

Q: What is behind starving the beast?

A: The belief that government dynamic as it is today is that no matter how much we collect, long term, government will spend more. Therefore, we need to limit how much we collect (this assumes one wants smaller government).

Q: Does this work short term?

A: No, in fact it may work perversely short term. It disconnects costs from benefits, and therefore may lead to more spending per dollar collected. If the long term trend is $1.20 spent per dollar collected, the short term effect of tax decreases may be to increase this to more than $1.20 per.

Q: So should those wanting smaller government raise taxes?

A: Not necessarily. Not if the theory is correct and we still spend more than we collect. All this does is delay the day of reckoning and increase the size of the beast that will eventually have to be dealt with. The bigger the beast, the poorer we will be and the harder the beast will fight.

Q: Aren’t republicans pushing brinksmanship?

A: Short term, yes, but they believe it is better to face the issue sooner and smaller rather than later and bigger.

Q: Doesn’t this allow republicans to pander to their base?

A; Yes. It in effect packages lowering taxes as good for us.

Q: Is this healthy?

A: Hell no, if we want smaller government, the healthiest way to do so is to make tough choices.

Q: So why don’t we?

A: It is political suicide today to push reality.

This is a strange topic because people are attacking something from different directions with different values, time frames and motives. Are we attacking a dysfunctional Republican strategy, or are we really just attacking a structural weakness in democracy itself? Something is insane and dysfunctional here.

In other words, instead of us all saying that starving the beast is insane, what are we actually arguing for?

Report

Roger, that’s quite a lengthy way of saying you agree starve the beast has been a colossal failure. I agree.

Insanity has famously beed defined as doing the same thing over and over again and expecting different results. In that starve the beast has demonstratedly failed one could make the arguement that the current GOP (and policital conservative movement) is once again taking aim at Starve the Beast strategies (much focus on tax cuts, much vagueness on spending cuts/much hiding behind the current gridlocked state of government on spending cuts) and is expecting different results which is arguably insane.

I just don’t buy the “this is a problem with democracy in general” line. Canada in the 90’s and Britain right bloody now is and has demonstrated that democracies are clearly capable of making painful spending cuts coupled with tax increases that result in balanced budgets, deficits under control and (in Canada’s case though ominously not so far in Britains case) economic growth.

The US has so far been unable to replicate this. The US, Canada and Britain are all democracies. Only the US has a conservative movement that wholeheartedly embraces the Starve the Beast strategy. Ceteris parabus the problem lies not with the nature of democracy but with starve the beast.Report

North,

The reason for the length is that this is a complex issue with lots of people talking past each other. I suspect we still are (see below)

Most of the arguments I read here and from conservative sources were related to this idea being dysfunctional at reducing short term spending. This is probably correct, but misses the point that it only makes sense as a long term (dangerous) strategy of taking deficits to the brink.

The solution for you is pretty easy. Let’s increase taxes wisely. My problem with this is that I believe the conservatives are right and Plinko is wrong and that spending will indeed go up faster than taxes in our current system. It all leads to the same place with only the date and size of the beast in question.

My solution is to drastically reduce spending and taxes and focus government on doing a limited range of things. The problem with my solution is it is politically DOA.

I admit the institutional dynamics may be different in different democracies. I do suspect the dynamic of democracy is attracted to overspending (as per public choice theory).

I agree there is a colossal failure somewhere. My question, is what should proponents of small government recommend instead that is politically viable?Report

Roger –

I decided to dip my toe back into this discussion.

Leaving aside the efficacy of “Starve the Beast.” What I want to know is: why would anyone assume that having to pay for increases in government spending, in the form of tax increases, would not be a dramatically more politically effective way of constraining spending. Unless there was genuine consensus on any new spending, a tax rise would be politically painful.

If taxes were raised to pay for, say, Medicare Part D, or the Iraq war, I guarantee (backed by the full faith and credit of my rhetoric) that they would have been implemented dramatically differently, if at all. It’s my personal opinion that STB was implemented in earnest in the first two years of the Reagan Administration, but its failure to touch spending in any sufficient way made the true believers give up. However, it was attractive for the charlatans, who could justify politically popular items (new and expanded government programs, with lower tax rates), and still appear to have a high-minded “conservative” rationale for it.

Unless the current practitioners of STB intend to drive the US into fiscal crisis (like Greece, or Argentina), and resurrect a Milton Friedmanesque government and economy from the ashes, I just don’t see how the current advocates of STB (which appears to be most of the right wing of the Republican party, given their continued support for tax cutting at a moment of historic non-war deficits) expects the strategy to pay off.Report

What I want to know is: why would anyone assume that having to pay for increases in government spending, in the form of tax increases, would not be a dramatically more politically effective way of constraining spending.

This.

Conversely, why all this talk of Starving the Beast rather than putting it on a diet?

When Harry Truman was first elected senator, he was viewed as a lackey for the corrupt Pendergast Machine from Kansas City. Truman shook off that opprobrium by going after waste and fraud in military procurement. His good work saved the country billions of dollars, in an era when a billion actually meant something.

It’s always more palatable to attack something in the abstract than to confront specific shortcomings and malfeasance. From personal experience, I can tell you the government’s nether parts are covered with contractor leeches, many tiers of them. I have been just such a leech.

Nobody in his right mind wants to eliminate necessary programs and their budgets but sunlight is the best disinfectant. I’m convinced we could cut about 20% of government expenditures by eliminating government contracting services. It’s scandalous how much taxpayer money we’re wasting.Report

Snarky,

I think the pain of higher taxes is indeed a brake on higher spending. The conservative and libertarian opponents of STB are arguing this pretty convincingly. The choice then becomes which path will we take…

Increase spending and taxes until taxpayers put their foot down, or…

Hold the line on taxes until deficits force the issue.

I take it that you prefer the former path. The risk of the second path is obvious, but there are risks of the former as well. The risks are that we will get extremely high spending, extremely high taxes, economic stagnation and a beast that is even more ferocious.

I agree STB attracts horrible abuses, widespread pandering and a race to the bottom. After all, if we are going to hit a crisis, we might as well do it pandering to our base rather than the other side’s.

I also agree that the strategy assumes an inevitable deficit showdown. STB speeds up the day of reckoning.Report

Blaise,

Are you recommending an offset strategy rather than STB then? Are you suggesting that small government types push a platform of fixed revenues and fixed spending with discipline of offsets, that is that every new expense be offset with a reduction somewhere else?

Would this be politically viable?Report

Here’s the fundamental problem: bureaucracies become self-perpetuating institutions. SEC arose in the wake of the Wall St crash of 1929. The FBI arose as a response to Prohibition-era interstate gangsters. The CIA arose as a response to the Cold War, NSA as a result of the spy satellite and telco technologies, NASA to the space race, Homeland Security in the wake of 9/11… all these agencies arose as a result of some perceived crises.

BlaiseP’s Law of Bureaucracy states “An army without an enemy will presently invent one.” We need to untangle the government from its attendant industrial complexes, establish bright lines for regulator and regulated. Look at some of the boondoggles we’ve perpetuated over time: look at the problems related to military base closures and moribund bureaucracies everywhere, outsourcing everything to an unseemly racket of contractors, jobs those bureaucrats ought to be doing and aren’t.

Bureaucracies are meant to enforce laws and do the business of the nation. Insofar as they’re properly run, they ought to be periodically reformulated by competent project managers, assessing priorities and addressing changes in the mission. Bureaucrats ought to be able to do their jobs: where they can’t do that job, it gets outsourced to untold tiers of contractors. We might have to spend more on bureaucratic salaries but we’d actually save money in so doing.

Those who advocate for Small Government ought to embrace the notion of fewer and more competent bureaucrats to administer our laws and programs.Report

Roger,

I’m a little confused that you’re attributing to me the strategy of increasing spending and increasing taxes when I have repeatedly both in examples and in personal advocacy advanced that the desirable course of action (and the action most demonstratably effective at dealing with deficit problems) is to raise taxes AND cut spending. This is the traditional method of dealing with deficits; conservatives trade increased taxes for decreased spending from liberals. This is the parameters of the deal that Bush senior cut with Democrats in the early 90’s (which resulted in budget surpluses and improving balances of accounts until STB true believers took full control in 2000). This is the method used by the Canadians in the early 90’s to bring that country from the brink of default to the fiscal catbird seat the country is occupying currently. This was also, I’ll note, the option extended most recently during the various deficit showdowns that occurred with the rise of the Tea Party.

It is also the traditional method for dealing with budget deficits; you cut spending and raise taxes together. No one is happy but because the unhappiness is spread broadly everyone grumbles and puts up with it. Starve the beast was developed as a wily alternative to this method which, it’s inventors reasoned, would allow them to spend their days handing out candy while forcing their opponents to eventually peddle the broccoli. The problem with this of course is that their opponents refused to play along and the result was decades of candy for all.

Obviously, as a libertarian you’d have considerable objection to this since this would result in only a modest reduction in size of government in this country. I have little sympathy since libertarians really need to advocate for their preferred government structures up front; not try and smuggle their preferred policies in under the skirts of some conservative induced fiscal crisis.Report

Blaise,

No argument from me on this approach. The problem of course comes from JH’s favorite topic– public choice. The incentives and dynamics of democracy lead to runaway, self perpetuating bureaucracies.

The issue then is changing the system somehow to resist this tendency.Report

The incentives and dynamics of democracy lead to runaway, self perpetuating bureaucracies. The issue then is changing the system somehow to resist this tendency.

We must return to first principles. Most regulatory law is written in blood. We simply must have an SEC, for example. We must have an FAA. That said, the mission of the SEC is constantly changing. Securities fraud is an ongoing problem: crooks are more inventive than the regulators. Nobody wants to fly in unsafe aircraft: until we’ve invented the Star Trek transporter, the FAA has an ongoing mission.

The bureaucrats are pawns in a game of Turf War. They’d like nothing better than to do their jobs more efficiently. Trouble is, the people who run SEC can barely be distinguished from those they regulate. The first step is to pull them apart and establish boundaries.Report

North,

My bad on false assumptions on your recommendation.

I agree that I would not be happy with raising taxes to pay for increased spending or lower rates of increase. These lead to a bad place. I would certainly approve raising FICA and Medicare taxes to make these programs self funding though. In past discussions the libertarians on this site have pretty much agreed here. They need to fund themselves (all the more reason to privatize most aspects of them). It helps that there is no longer a surplus to raid, otherwise shenanigans would occur.

I think your point that libertarians should not hide under the skirts of STB is a real strong one. I would not advocate lowering taxes to starve the beast. I would recommend lower taxes and lower spending, but I am aware that is politically a non starter. The question becomes who do I vote for in the real world. A STB’er or a tax and spender?Report

Blaise,

In thirty years of working in and running bureaucracies I have rarely found them to want to “do their jobs more efficiently”.

The dynamic in bureaucracies is to grow in staffing, budget, regulations, paperwork, and responsibility. In addition they resist change to the core of their being. In government bureaucracies it is even more perverse, as they also are inventivized not to solve the problem, but to perpetuate it and even grow it opaquely.Report

In thirty years of working in and running bureaucracies I have rarely found them to want to “do their jobs more efficiently”.

I’ve been around both government and private bureaucracies. Government bureaucracies are often quite efficient, when they’re allowed to be. US Army procurement, US Transportation Command, USDA, I’ve watched all of them make changes with startling speed. When the paperwork gets too onerous, mistakes get made and that’s when I enter the picture.

So maybe I get to see a better cut of Gummint Bureaucrats. It’s the private sector bureaucrats, especially within health care, that drive me insane.

The dynamic in bureaucracies is to grow in staffing, budget, regulations, paperwork, and responsibility.

Conversely, when the regs and mission change and responsibilities increase, the bureaucrats are treated like worthless scum. Their opinions aren’t solicited. They’re told to put the five pounds of shit in the two pound box and everyone wonders why the process breaks down.

In addition they resist change to the core of their being. In government bureaucracies it is even more perverse, as they also are inventivized not to solve the problem, but to perpetuate it and even grow it opaquely.

A certain amount of inertia is present in all bureaucracies. You’d be surprised, though, to see the bureaucrats when my business analysts talk to them about this Resistance to Change. They’re often being judged on conformance to outdated standards. They know they’re not doing things the reasonable way. Given half a chance, they’ll tell my BAs, often in tears, just how stupid and demeaning their jobs have become.Report

Roger:

If I were a libertarian I would (arguably) waste my vote on a true libertarian candidate and try and make the starve the beast party come to their senses and either go libertarian or at least traditional cut spending by cutting spending conservative.

Frankly I think starve the beast is especially poisonous to libertarian positions because it makes people view government services without considering costs. Starve the beast undermines libertarian principles pretty much directly and the only possible payoff comes from assumption that the government will be collapsed at some point in the future and replaced with a small government alternative.Report

North,

I find much wisdom in your words.Report

Blaise,

The problem bureaucrats face is that they work in bureaucracies. The institutional dynamics and incentives lead them to perverse places.Report

@Blaise,

when the regs and mission change

This point can’t be over-emphasized. It’s a crucial theme in James Q. Wilson’s classic book , Bureaucracy: What Government Agencies Do and Why They Do It.

An agency that has a clear mission is often very effective. The usual caveats about lack of proper incentives and non-priced products still apply, but in what they do they are very focused and effective. But when their mission changes, or they are given fragmented or contradictory missions, they really tend to falter.

Why did FEMA do such a bad job in New Orleans? Because after being stupidly shoved into the new DHS it was forced to focus its planning efforts on terrorism prevention and response. It’s such a predictable problem that people were pointing out the risks long before Katrina hit.Report

Maybe I’m not understanding you or the thread here, but what you wrote above doesn’t seem to follow. At least, it isn’t obvious that it does. This claim

The claim from the left is that starving the beast is stupid and useless act of self deception.

can be supported by empirical evidence. But this claim

To convince them [TPers] that starving the beast is useless you would need to convince them that growth in government would not have been even worse absent their starvation diet.

is impossible to empirically demonstrate. So I don’t think both sides are on equal footing here.

Now, if this whole argument takes place in utopia-land where counterveiling evidence is reflexively denied because it doesn’t fit the theory, then you have a point. But by hypothesis, we’re talking about the real world and normal standards of evidence here, no?

Report

All,

Here is an article from Cato on the issue and how it cannot work as well.Report

http://www.cato.org/pubs/journal/cj26n3/cj26n3-8.pdfReport

Roger,

Excellent link, thanks. It being by Niskanen, it goes right into the public choice approach I touched on. Niskanen, by the way, died last October; a sad loss.Report

James H,

You never weighed in on what strategy you recommended instead of STB. As my string above lays out, I do not believe short term deficit reductions are the measure of success or failure of the program (those these may be how it is sold to voters). Those economists and political scientists that still endorse it are doing so upon the belief that long term American democracy as the dynamic works today will spend more than receipts.

The strategy of starve the beast thus becomes one of hastening the showdown crisis while taxes are still low, the economy is still growing and the beast is still manageable.

Obviously this is a risky gamble. In a perfect world I would recommend lower taxes and spending and assume you would too. But we live in the real world, and I wonder what you recommend instead that is politically viable.Report

Roger,

I don’t know if there is a successful strategy except for pushing the state to failure and hoping for the best. And frankly, I don’t think that’s worth the price and risk. Sure, as a libertarian I want a smaller government that does less, but I also recognize that I’m just one of 300 million people, and the means I advocate toward my end are not necessarily justified by the end. I also recognize that my less-preferred world of more government expenditures isn’t exactly hell on earth. I can live with it, although I will perpetually grumble about it. But economic collapse doesn’t always lead to libertarian reforms–it is, historically, at least as likely to lead to authoritarian reforms and/or civil war. That’s why I think STB is foolish and short-sighted.

My preferred way is a balanced budget amendment (or, more specifically, an unbalanced budget amendment, requiring a surplus when the economy is growing). And that requires continuing to argue and debate about why we need it. Will the arguing and debate work? Who knows, but if it does we’ll have no need for STB. If it doesn’t, we may end up with STB by default.Report

James,

Thanks. I kind of landed in the same place in my discussion with North

I think the down side is the risk that we get to a showdown either way. We need a conservative party that refuses net spending increases, not one that offers lower taxes, additions to medicare, and an unfunded series of wars.

Report

Roger, as James has noted Starve the beast proponents should be able to show several of the outcomes that they predicted would occur that haven’t:

-STB Proponents asserted that by slashing taxes without slashing spending deficit hawks would force spending decreases. This has been disproven. Instead voters have demonstrated indifference to deficits as a general rule unless they’re partisans for a party (either party note) that is out of power. What few deficit hawks remained have been carried along squawking in a deluge of increased spending.

-STB proponents asserted that STB would produce decreased spending and diminished government programs. Instead programs have grown, spending has grown and borrowing has grown.

-STB proponents asserted that STB policies would strengthen small government spending cutters on both sides of the aisle. While Democrats have moderated to some small degree the former party of spending restraint has demonstratably and dramatically ceased to be the party of spending restraint (courtesy of their utter abandonment of spending restraint principles when they were in power). So much so that the Tea Party has formed to protest excessive spending. In essence the Tea Party phenomena is itself proof of the failure of the GOP’s starve the beast position.Report

In essence the Tea Party phenomena is itself proof of the failure of the GOP’s starve the beast position.

Excellent North. I kept stumbling around this very point but couldn’t quite put my finger on it. And what follows from this, if it’s right, is that the neo-STBers are utopian idealists, immune to evidence or argument.

Report

Thanks Stillwater,

I actually haven’t seen many neo-STBers about, well except maybe for the editorial board of NRO.Report

North,

Are they a repudiation of it or a reincarnation of it?Report

Well, depends on your point in time. Initially I’d say (if I were being charitable) that they were a repudiation of it; now days they seem to have evolved into a reincarnation of it.

Report

Starve the Beast *MIGHT* have worked *MAYBE* if 9/11 didn’t happen.

As it is, I think we have to say that the plan did not survive first contact with the enemy.

Maybe Canada could provide an example of what tight fiscal discipline looks like with a leader who has enough of a mandate to say “we don’t have the cash for that” but not enough of a mandate to say “we need a national registry of ladyparts”.Report

Weeeelll… for it to work, it’d have to still work, measurably, at some point. Granted, an exception scenario may muck things up, but eventually you’d still see some measurable effect… if not 2 years later, certainly 7.

In a more general point, if your fiscal policy requires a period of time when an outside force doesn’t impose a pretty big crisis, and the period > the expected incident of major exceptions, by design, it’s extremely likely to fail. If you need to starve the beast for a decade before it starts to work, and fiscal crisis occur about once in every decade, you’re kinda screwed.

The problem isn’t that plans don’t survive the first contact with the enemy.

The problem is when you keep trying to follow the plan after the Germans go through Belgium and machine gun nests prove to be useful against cavalry, Joffre.Report

Would 1995-2001 count? If not, then I have no examples of maybe it working under ideal circumstances. “But that wasn’t starve the beast!”, okay fine.Report

Starve the Beast started in 1981 (nee David Stockman). If the beast ain’t dead yet, 31 years later, I would be hard pressed to make a case that it works…Report

Oh, I certainly wouldn’t argue that it *HAS* worked. It certainly has *NOT*.

We were on a decent vector there for a handful of years, though.Report

Yes Jaybird but can much if any of that be attributed to Starve the Beast? I mean there’s a part of the credit that goes to gridlock, another part that goes to economic growth (coupled with gridlock) and then finally the Bush I GOP and the House/Senate Democrats of the early 90’s cut a deal that cut spending and raised taxes which precipitated the good times for the rest of the decade. I just don’t see any part of that accruing to Starve the Beast. If anything I’d say the 90’s prosperity was the outcome of the last gasp of the GOP old school of cutting spending by cutting spending. Bush I lost the presidency at least partially due to his sensible deal that happened to raise taxes.Report

@Snarky, I reiterate that there has NEVER been a starve the beast in this country, and by never I mean NEVER. Stockman may have given it a try, but while you and others point out who was president during those years you completely ignore which branch of gov’t pulls the purse strings (Congress). Only a majority in Congress can effect fiscal change and all the political promises in the world don’t stand up to the light of public scrutiny when pork is at stake. The term “3rd rail” came into parlance during the budget battles with Tip O’Neil.Report

What would “Part II of Starve the Beast” look like if *NOT* that?

Greece and Greece alone?Report

Ward, it depends on your definitions which I suspect are being muddled.

If you’re talking about cutting spending directly (also known as throwing the poor out to die to Dems or letting the Commies/islamists/etc just walk in and conquor everything to the GOP) then yes it’s not been very heavily tackled. I’d submit however that this is not starving the beast as it’s commonly used in political discourse.

Starve the beast in general discourse is the strategy of keeping tax revenue low and lowering it whenever possible in hopes (mistaken in my opinion) that this will force the government to cut spending when the money runs out. By this definition of course it’s been the policy of one party in this country for 30 odd years and I’d say it’s been very thoroughly tried out (and found badly wanting).Report

Nope Starve the Beast never happened and this is why: Report

Report

Hmm it’s cute, but to be frank I don’t see the pertinance.Report

Canada definitly wouldn’t work Jaybird. Their budgets were balanced by a center left Prime Minister and party who made the strategic decision to steal the sensible parts of their (destroyed) opponents fiscal platform. You’d never have caught them plotting to register lady parts.. though they did register long guns.Report

Oh, Harper’s not center-left. Is he???Report

North is referring to the Liberal governments of the 90’s.Report

Jay, Harper is the conservative Prime Minister under whom the Canadian government has ceased to balance their budget and under who’s administration they’ve resumed running budget deficits after years and years of Liberals balancing the books. Many Canadians very uncharitably call him Bush lite.

In fairness to him Canada did have a recession (and the Liberals were long due for some time out of power) and I’d be surprised if he doesn’t eventually get the books back in order. But he ain’t no great corrector of government profligacy.Report

Whew! I was freaking out.

You wouldn’t believe what my in-laws call him, you see. If he was “center-left”, my head was going to explode.Report

On the other hand, I think that Greece is about to show us what “Starve The Beast” will look like in real time.Report

I’m not suggesting that Republican voters are deluded idiots, that post’s coming tomorrow ;). All I’m saying is that it would appear that Starve the Beast has failed to rein in the expansion of government spending, meaning that even if it works it doesn’t work well enough and that means other measures are called for.

There’s a difference between being wrong and being deluded.Report

What “starvation diet” has EVER occurred with this government? I’ve never seen it. Don’t believe the headlines, when politicians talk about “reductions” they are REALLY talking about spending more at a slower pace than they were originally planning. When the taxes don’t meet the budget they just borrow more. Borrowing at a clip approaching 45% is not “starving” in any meaningful sense of the word.

State governments are in a different boat because they can’t borrow based on the “full faith and credit of the US Government” (thank God). State budgets get mightily skewed because of the influence of Uncle Sam, he can give them money, loan them money or withhold money, sometimes all three. For all the supposed belt-tightening in the states, I’ve personally seen tons more that could take place. There is a discipline that is inherent in operating a business that is sorely lacking in government at all levels.Report

Without that time machine, you cannot “prove” the supposition one way or the other.

But the inferences one can make from available evidence (such as that I posited) suggests that it’s a pretty dubious proposition. What it is is politically easy to do, once you’ve constructed a plausible intellectual justification for running continuous deficits (“supply-side econonimics”).

I don’t think that history will regard this era with much kindness.

Report

Snarky,

Perhaps history will look back and view democracy like we view slavery or cannibalism or leaching disease.Report

To convince them that starving the beast is useless you would need to convince them that growth in government would not have been even worse absent their starvation diet.

That’s a burden which cannot be met.Report

Exactly.Report

So the conservatives continue to believe in Starve the Beast because it sounds good and it’s easy and pleasant to do? If that’s true then (while I’m too young to know personally) I would suspect that fiscal conservatism has fallen a long long way from its state in the 80’s and 90’s.Report

Fascinating (though my Chrome version shows a few typos that may be spacing errors–don’t know how it shows up on other browsers),

Question, though: what’s the benefit of “spreading the tax around” rather than concentrating on one area?

I like the idea of a property value tax only scheme (not, by the way, the “land value” rent system of the Georgians) as it keeps what I would consider “proper” progressivity while doing two things very well: one: raising enough revenue and two: keeping the voters on their toes regarding taxes (which encourages them to keep their legislators on point).

Your thoughts?

GMP

p.s. Nice picture! Did you get in on the Order of the Stick Kickstarter?Report

It wouldn’t surprise me if there were some typos, I’m the world’s worst proof-reader.

There are two reasons why it pays to spread your taxes out:

1) The negative effects of taxes are non-linear, the economic harm caused by raising income taxes from 10% to 11% is much lower than the harm caused by raising income taxes from 90% to 91%. Multiple taxes let you keep your rates lower, which adds up to less distortion of the economy.

2) Every tax has different strategies to avoid it. If you have only one tax, people have an incentive to work out and implement ways to avoid that tax. But if you have many taxes, it won’t be worth it to work hard to avoid any one of them.

Property taxes have merit certainly, though the advantage of taxing land specifically is that it’s a zero distortion tax that’s impossible to avoid, but if you tax the building as well, you create incentives to let buildings run down to avoid a tax bill. That means a regime based on land taxes alone would be as efficient as a tax system can get, as well as being progressive.

The downside is political. In the first case, you’ll have problem with people who are asset rich, but cash poor (i.e. retired people), and in the second case a system of pure property taxes will leave a significant fraction of the population who pay no taxes at all. This can create perverse incentives in the political process.Report

Here’s a question I’d like honestly discussed:

Should capital gains be taxed at a different rate from income? I’m not sure why capital pays a different rate than labor — I’ve heard the arguments (“stimulates investment!” comes most readily to mind), but is it anything but a cheap slogan?

Looking over the last few decades, I can’t see a reason — other than to coddle the wealthy — to really tax investment differently than labor.

Want to simplify the tax code? For people, it’s ALL income. Whether it’s from your job, your investments, or your bank — it all goes together into combined income. No seperate rates.

And don’t get me started on that carried interest stuff.Report

Why not coddle Labor instead? Bring Labor’s rates down to around investment level taxation rates.Report

Yes, why not coddle Labor to the same extent we’ve coddled Management? I recommend outsourcing management of some of these corporations to some crafty cabal of women in some third-world marketplace. Certainly be cheaper.Report

Morat,

There is the issue of time frames. Capital gains is distorted by the longer time frames. If adjusted for inflation, I see no reason we should incentivize capital more or less then labor.Report

Well, because of inflation, the “returns” from any long-term investment are overstated. If I earn an 8% return on an investment, and the inflation rate is 4%, I have really only earned 4%. And if the tax rates for earned and unearned income were identical, I’d be paying twice the effective tax rate.

Beyond that, no, I cannot think of any good reason that unearned income should have priveleged tax treatment. If inflation adjustments were factored in when an investor pays his capital gains, I think the rates should be the same.