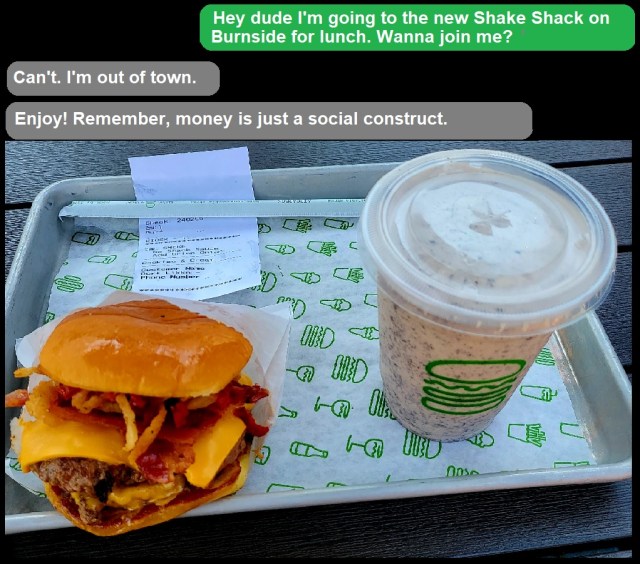

The picture above is a reconstruction. The original picture and the original text exchange were lost forever last Sunday when my phone slipped out of my pocket while I was on a hike, and fell into the Sandy River. The original text exchange, which was substantially close to what is illustrated, took place in late April of 2023, a day or two after Shake Shack opened a location across the street from Powell’s City of Books in downtown Portland.

As proof of my love for you all, I went back to that Shake Shack today (19 May 2023) and ordered a lunch so as to collect a photograph for this article. This should amply demonstrate that although my friend was cracking a joke, it’s one of those jokes that’s funny because it’s true. What you see there is a “Smoke Shack” burger with crispy onions, accompanied by a cookies-and-cream shake. No fries. They didn’t even wait until the cheese was melted before bringing it out to me. After a 10% tip for the staff, my credit card had an additional $20.79 of debt on the account. That’s close to $21 for a fast food burger, no fries, and a shake.

Now, the quality was pretty good for fast food, but it was hardly an earth-movingly good meal. If I’m going to drop $21 on lunch, and I’m not trying to collect a point to make and a photograph to use for a blog post, I’d drop that $21 at any number of better places in downtown Portland. So it’s a good thing money is just a social construct (and yes, actually, it is exactly that) because otherwise, I might just have to accept the proposition that if you want something even halfway good in the world, you need to be prepared to pay for it.

I was reminded of that the moment I sat down to await my food by perusing my Twitter feed. All over the news that morning was debt ceiling brinksmanship by House Republicans, and folks were worried about it, and rightfully so. I thought, “If I want a decent burger, I guess this is what it costs; if we want a functional government, that’s going to cost something, too.”

Why do I think it’s McCarthy as the willful aggressor rather than Biden? Because I’ve not heard any representative of the Republicans bothering to explain in any detailed way what the cuts they want are or why they would be good for the country. McCarthy himself doesn’t seem to have his heart in it–his attitude seems to be “This is what I had to promise a critical segment of my caucus to get my speakership, so I have to do this.” So he’s doing it, but doesn’t really have any passion for why he’s doing it or what the real result would be. The people who are driving it can’t or won’t articulate why, and presumably their supporters have just already bought into a generalized concept of “less government spending is better,” whether that’s true or not.

The spectacle of Kevin McCarthy holding a knife to the global economy’s throat is terrifying and grossly irresponsible. McCarthy was feckless, weak, and probably not particularly smart, and that’s how he wound up having to cave on this to his populist wing. It’s not clear to me that the populist wing of the GOP understands what they’re trying to accomplish by doing this or that the threat they’re using to backg up their incoherent demands is “we’ll own-goal the entire world’s economy with the most catastrophic economic event since Black Friday in 1929.”

Worse, the Wall Street wing of the GOP, who I presume do understand what’s at stake, doesn’t seem able to do what it clearly needs to — defect and vote with the Democrats to raise the debt ceiling and get us the hell out of this mess. With the result that once again, we hurtle precipitously towards the crescendo of the ten-to-fifteen month periodic ritual of Republicans dousing us all in gasoline and threatening to ignite fireworks, while simultaneously throwing a temper tantrum for ill-defined and untargeted spending cuts without even really understanding what good thing is supposed to happen if we get them or what bad thing might happen if we made those cuts unintelligently.

And the worst part is, they are credible in making this nihilistic, self-destructive threat. So I wasn’t hugely surprised when the very first tweet I saw from someone who wasn’t a friend or an Ordinary Times adjacent personality was this:

As republicans have walked away from negotiating we're inching closer and closer to absolute catastrophe. I wrote about why it's time to stop with the nonsense, mint the damn coin and move on.

Read @inthesetimesmag

https://t.co/zamB0v04ZE

— Mo Weeks (@mo87mo87) May 19, 2023

“Mint the damn coin,” or more specifically, #MintTheCoin, is supposed to be the silver bullet out of our current predicament. It’s based on a combination magical thinking and a particular way of reading 31 U.S.C. § 5112(k):

The Secretary may mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.

By “particular way,” I mean “in a way that is completely and derangedly devoid of any other context.” So sure, if you just read that one sentence in isolation, it looks like Janet Yellen is authorized to mint as many coins in whatever denomination she chooses as long as she uses platinum to do it. Secretary Yellen presumably would consult with President Biden before doing such a thing, but there seems to be nothing to stop her from getting an artist to inscribe a stamp with some dignified-looking artwork, the words “United States of America,” “In God We Trust,” “E Pluribus Unum” “One Trillion Dollars,” and “Liberty,” and most importantly the words “One Trillion Dollars” bestowing a denomination on the coin. Because hey, if money is just a social construct, so is law!

Thanks to the magic of seigniorage, the Platinum Bugs argue, there’s effectively a trillion new dollars that the Treasury is holding because the cost of an ounce of platinum is trivial compared to the value of the coin once the government bestows its fiat upon it.

As an exercise in pointing out how absolutely batshit insane the Republicans holding the U.S. government’s reliability as a debtor is, I suppose #MintTheCoin serves that purpose. It also serves as admirable fodder for right wing folks who feel the need to have some sort of retort to accusations that their side of the debate has been co-opted by wooly-headed conspiracy theories like QAnon and Trumpian confabulations. Government By Twitter Hashtag and Fevered Magical Imaginings is not likely to lead to good ideas, whether those ideas or left-leaning (#MintTheCoin) or right-leaning (“Don’t just starve the beast, blow it the f– up!”).

So let’s be real: #MintTheCoin is today’s permutation of the 1970’s call to “fight inflation by printing more money” and it’s an awful idea for the same reason: it would explode M1. As anyone who’s taken macroeconomics should recall, M1 is defined as “currency in circulation plus commercial bank and other liquid cash deposits” or more simply, it is a reasonable enough metric to answer the question “How much money is there in the whole economy?” As of the close of Q1 in 2023, it was about $19 trillion.

I don’t think you need an advanced economics degree to realize that more than doubling M1 overnight without a similar increase in goods and services productivity would be massively inflationary. Even if you couldn’t puzzle through that on your own, there is the recent example of Zimbabwe, which relied upon seigniorage as a source for up to a quarter of its annual governmental revenue for nearly a decade. The result was five-digit hyperinflation and an utterly wrecked economy from which the country still has not really recovered. #MintTheCoin advocates have not offered a plausible explanation, in my opinion, as to why we would expect any different a result in the US than Zimbabwe got; it’s a worse idea than fighting cancer by smoking more cigarettes, because exploding M1 would work faster.

#MintTheCoin has another downside: it’d be illegal. It ignores the fact that the Fed, not the Treasury, controls the money supply; further, it ignores that 31 U.S.C. § 5112(k) is one part of an Act of Congress authorizing the Treasury to mint a limited amount of “commemorative” coins as a profit-making numismatic enterprise, and thus isn’t intended to create “legal tender for all debts” the way true currency is supposed to be.

At this point, I was done with the burger. The burger was good! It was not great. But I still had some milkshake and hadn’t really finished fretting about politics yet despite distracting myself with looking into just how awful an idea #MintTheCoin would actually be. And while enjoying the rest of my milkshake, I found out there’s a more interesting cluster of ideas out there to circumvent a potential failure by Congress to raise the debt ceiling. They seem like they have a more plausible chance of passing legal muster and reaching the point where we could ask not just “is this possible?” but “is this a reasonable way forward?”

There’s a financial instrument called a consol, also known as a perpetual bond. It’s a financial instrument with no maturity date. It pays interest at a specified rate until it is repurchased; the borrower can purchase it at will. The mandatory interest payments are a liability, but the amount of the bond isn’t a “debt.” So instead of minting a trillion-dollar coin, which could not realistically be negotiated anywhere anyway, the government could issue a trillion dollars’ worth of consols. Several European nations have used consols to finance their debts, particularly debts accumulated very quickly in times of war. The earliest use seems to have been by the UK in the 1750’s. Again, why isn’t this a “debt”? Becasue the creditor has no enforcement rights on the principal. The principal is repayable “at the pleasure of the obligee,” where here the party obligated is the U.S. Government.

As an investment vehicle, there are some serious downsides. It’s low risk, low-return, because while the interest rate promised is low, it lacks a maturity date and therefore lacks a predictable ROI. Particularly problematic if the interest doesn’t offer an ROI in excess of inflation. And even in a low-risk portfolio, because the principal can be bought back at any time by the obligee (probably fractionally at the obligee’s option), there’s a significant risk of long-term loss.

As a financial planning instrument, again there’s a downside: even though the consol isn’t necessarily repayable at any particular time, it does eventually have to be bought back.1 So there is a plausible argument that a consol would be a “debt” and therefore issuing consols falls within the power and discretion of Congress to authorize, or not.

We don’t know the answers to any of those issues yet. The United States has, so far as I can tell, never issued consols as financial instruments. We’d be sailing into uncharted waters.

In the short run, it’s pretty certain that if the Treasury were to auction off a trillion dollars’ worth of consols, securities repayable “at the pleasure of the United States of America” and bearing interest obtained at the bid rate, a trillion dollars could be raised with about the same degree of administrative fuss as the Treasury incurs now issuing T-bills. There would be a legal challenge as to whether a consol is authorized by law, and if so whether it is a debt for purposes of the debt ceiling law. But it would provide a means for the government to keep on paying its bills even while the challenges were pending.

In the inevitable legal challenges arising out of both sides failing to blink, you can bet the government would raise Section Four of the Fourteenth Amendment to the Constitution. Article I, Section 8 gives to Congress, not the President, the power “…to pay the Debts [of and t]o borrow Money on the credit of the United States,” but this was at least debatably amended in 1868, when the Constitution was amended thus:

The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned. But neither the United States nor any State shall assume or pay any debt or obligation incurred in aid of insurrection or rebellion against the United States, or any claim for the loss or emancipation of any slave; but all such debts, obligations and claims shall be held illegal and void.

This was meant when originally passed to forever place repayment of bonds issued to finance the Civil War out of the reach of the pro-Southern Democrats (and, in its second sentence, to forever leave creditors of the former Confederacy out to dry). But there’s the text, and it seems plausible that it means in 1868 when it was adopted, Congress was stripped, at minimum, of the power to refuse to pay the government’s debts. The President, who under Article II, Section 3 must “take care that the laws be faithfully executed,” could then interpret that even in the absence of Congressional authority to do so, he has an obligation to honor debt obligations because of previous laws authorizing the issuance of that debt. The money has to come from somewhere, and a consol is at least debatably a form of obligation that is not a debt because it is repayable at the pleasure of the creditee, so Congress might lack power to prevent the President from issuing a consol.

Alternatively, of course, the law imposing the debt ceiling might be deemed inoperative as unconstitutional (at least in the instance of a threatened default), and the President could simply order the Secretary of the Treasury to issue more T-bills, standard and familiar debt instruments, based on the authority of the Fourteenth Amendment. That would be the first argument, but I can see that argument failing — because the Fourteenth Amendment does not say that the President may take action to pay debts in defiance of an explicit Congressional limitation on his instructions to spend public money.

In Youngstown Sheet & Tube v. Sawyer, 343 U.S. 579 (1952), President Truman intervened in a threatened national labor strike by steelworkers, purporting to seize certain steel mills as vital to the war effort (the war being the conflict in Korea) and order the management to concede to the steelworkers’ pay demands pending resolution of the dispute so that they would continue working. In effect, of course, this would have made the wages demanded by the workers permanent because really, how could management go back from having paid them while under Federal stewardship? So the executives of the steel mills, on behalf of their stockholders, challenged Truman’s seizure of the mills.

They won, but did so by way of a badly-fragmented opinion. About all that a majority of the Court could agree on was that the President could not seize and operate a private business without a Congressional grant of authority to so act. The phrasing of that reasoning came in a concurring opinion from Justice Robert Jackson, which somewhat recently was restated:

First, when the President acts pursuant to an express or implied authorization of Congress, his authority is at its maximum, for it includes all that he possesses in his own right plus all that Congress can delegate. when the President acts in absence of either a congressional grant or denial of authority, he can only rely upon his own independent powers, but there is a zone of twilight in which he and Congress may have concurrent authority, or in which its distribution is uncertain. In such a circumstance, Presidential authority can derive support from congressional inertia, indifference or quiescence. Finally, when the President takes measures incompatible with the expressed or implied will of Congress, his power is at its lowest ebb, and the Court can sustain his actions only by disabling the Congress from acting upon the subject.

Cleaned up from Medellin v. Texas, 552 U.S. 491, 524–25 (2008) (quoting Youngstown Sheet & Tube, 343 U.S. at 635-38, Jackson, J.)

So here, in the arena of what to do if both sides of this debt ceiling impasse refuse to blink, we have three things that the President could do unilaterally to protect the economy from the irrational destruction the Republicans threaten to wreak upon it. First, he can directly challenge the debt ceiling limitation as unconstitutional, either on its face or as applied under circumstances that would call the debt of the United States into question.2 If successful, he can issue more rolling debts, which means sell more T-bills and use the proceeds to keep on paying the government’s bills.

Second, he can make debt payments either by issuing more debt in defiance of the debt. This would be a “low ebb” scenario under Jackson’s formulation in Youngstown and that makes me dubious. Alternatively, he could auction consols and make debt payments from those sales. That might only work once or twice if the Court were to decide that consols were also “debts” of the United States, and therefore his auctioning them off was itself illegal and possibly unconstitutional. Or, if a consol is not a “debt,” because it’s repayable only at the discretion of Congress, then it falls in the “twilight zone” where the President can act within a plausible claim of inherent executive power.

And third, I guess, he could #MintTheCoin. This would be a really bad idea, of course, because it is both illegal upon more than superficial contemplation, and even if done successfully regardless of legality, would leave us following the dismal example of systemic financial failure set by the Mugabe government of Zimbabwe, a failure from which that nation has still not recovered in any meaningful sense.

The fact of the matter is we need the government to spend money. In a lot of ways, in a lot of places. If that doesn’t happen, really really bad things will result from it. Government shutdowns hurt the economy. A government default on debt service would be an unmitigated disaster, the worst thing to happen to the U.S. economy and indeed the global economy since 1929. And that means we need to continue spending our money. If we’re going to cut the budget (why do we need to do that again?) we need to do so strategically and thoughtfully. What’s being demanded on the GOP side of the table isn’t it. And yeah, there’s sticker shock for what things are about to cost. Just like I had sticker shock buying a better-than-mediocre burger for lunch today.

The Republicans are closing their eyes and holding their breaths hoping that magic, harmless spending cuts will come their way; and at least certain Democrats are also closing their eyes and holding their breaths hoping that money will appear, one ounce of platinum at a time, in sufficient numbers to harmlessly solve the problem. Everyone needs to stop thinking magically and start behaving with the responsibility we voters ought to demand from those to whom we entrust the commonweal.

There are grownups in the room, on both sides of the aisle, and they are the ones who need to be calling the shots. Someone willing to tell Wall Street they’ll default the national debt is not among that number. Nor is someone who thinks we can conjure trillions of dollars from two pounds of metal.

If you’d spent twenty-one of your dollars on a burger and a shake along with me, as my friend was unable to do because he was out of town, this could have been our lunchtime conversation! If that sounds good to you, make some plans, come to Portland, and let’s meet up for lunch!

- Maybe not! Maybe they get issued and become a form of passive government income for whoever holds them… forever! This could be banks and other financial institutions, but maybe individuals too? Also, it’s pretty clear there’d be a secondary market for them. Maybe they’re the gateway to a dystopian future of economic polarization, by which the descendants of today’s very wealthy who could buy the consols are supported by them on the backs of tax dollars collected by the descendants of today’s poor. Or, maybe very optimistically, they become a back door form of universal minimal income. Or maybe low ROI and high interest diminish the future payments and future principal to little more than a nuisance to the government and little more than a pittance to the recipients.

- What good the debt ceiling law would do without applicability in that circumstance? None. But the Supreme Court has neutered laws without completely overturning them before.

This is all just another data point of the Republicans being an insurrectionist faction, refusing to accept their fellow citizens as equals.

DeSantis with Disney in Florida, Texas stripping local jurisdiction, conservatives trying to destroy Budweiser- the message is always the same- Dare to tolerate those we hate and we will use any means to destroy you.Report

Except that that is all nonsense.

It may not be ‘intended’ to create legal tender(see below), but it DOES. It flatly does. Commemorative coins clearly are legal tender. I am sitting here looking at a United States Eisenhower Centennial Silver dollar, which came in a clear plastic case and a nice green holder and was a high school graduation gift. It has 0.77344 ounces of silver in it and it’s currently worth, in this mint condition with a certificate of authenticity, about $35 dollars. And it has, very clearly printed on it, One Dollar, and as far as I am aware, _I can use it as legal tender_. It would be stupid, and I’d have to get it out of the sealed plastic, but I could.

In fact, the Mint itself is pretty damn certain it’s legal tender: “Although these coins are legal tender, they are not minted for general circulation. ” – https://www.usmint.gov/learn/coin-and-medal-programs/commemorative-coins

And, on top of that, there’s absolutely no evidence that Congress didn’t intend for these to be legal tender…indeed, it would be incredibly odd for Congress to _denominate them_ in legal tender if they were not intended to be…the law explicitly talks about commemorative silver _dollars_ denominated as ‘One Dollar’, and what _exactly_ do we think they mean by the word ‘dollar’ if not a measure of an amount of money?

Congress did not say ‘We shall tell the Mint to make things that look nice but are not technically legal currency’, Congress said ‘We shall tell the Mint to produce very expensive and collectable legal currency that people probably aren’t going to use very much as currency’.

As the entire basis of that Justia’s article is that these coins somehow aren’t ‘intended to be legal tender’, that entire objection sorta falls apart.Report

Actually, the claim in the article is the even less supported ‘And because the coins are commemorative and valid only when sold to the public, the Federal Reserve is prohibited by law from accepting them on deposit to prevent the government’s checks from bouncing.’ claim, which is not only is not true, but I literally can’t figure out why they think that.

The Treasure is instructed _to_ sell commemorate coins it mints to the public at the cost of minting the coin instead of the valuation of the coin, but that isn’t what makes them legal tender, but…that weirdly doesn’t even apply to the platinum coin, just gold and silver ones.

Incidentally, the law explicitly says, which I just noticed: 5132(a)(1)(h) The coins issued under this title shall be legal tender as provided in section 5103 of this title.

The platinum coin, notable in the same fricking subsection! 5132(a)(1)(k) The Secretary may mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.

There’s actually nothing about how to issue them, no directions to sell them for certain values or anything! Unlike both gold and silver coins which have pretty detailed laws.Report

Do you also think I’m wrong about #MintTheCoin leading to hyperinflation by way of rapid M1 expansion?Report

The next trillion dollars worth of bonds sold are not going to be purchased with dollars where the holder said, “Think I’ll buy Treasuries instead of consumer goods.” Or at least, if they are, the first thing the Fed will have to deal with is a nasty recession, and possibly a bout of deflation.Report

M1 is the amount of physical money _in circulation_. I’m pretty sure that while the coin would, in some legal sense, be ‘in circulation’, it wouldn’t be in circulation in any practical sense. No one can actually _use_ the coin except for depositing it with the Federal Reserve. The outcome of minting the coin is that a number is moved from one account to another at the Fed and now they have a coin they have to keep in a vault somewhere. It doesn’t increase any money that any person or institution has beside that, and hence cannot cause inflation.

Now, could the Fed respond with their new extra-trillion dollar in their bank account by…doing something stupid? Like having banks lend out more money. Yeah, but they can do stupid stuff all the time, and there doesn’t seem to be any obvious reason this would cause that.Report

I kinda see the coin is something like “bull$#!+ handwaving that avoids the deeper issue”.

If there’s going to be a problem, it’s that my take on that might be shared by someone with actual authority/power or the like.Report

Gonna quibble with your definition of M1 because you omit liquid deposits in banking institutions. If you’re just looking at currency, and omitting deposits altogether, what you’ve got is M0 and that’s a far smaller number than M1. As for the reserve ratio to which you refer, the Fed already reduced it to zero, more than three years ago, and it seems content to leave it there (presumably, not enough banks have failed from overextension yet to raise the Governors’ concern).

But we aren’t talking about the Fed here. The Fed doesn’t resolve the government’s debts, it doesn’t collect taxes, it doesn’t redistribute the government’s money at the pleasure of Congress. That’s the job of the Treasury.

You’re very probably correct that the only two parties anywhere that could use a $1,000,000,000,000 coin would be the U.S. Treasury and the Federal Reserve. Plenty of private businesses already refuse most cash transactions (try to buy a beer on an airplane with currency, for instance, and I bet you’ll stay thirsty). Query, then, if calling a physical object “legal tender” has the significance either of us attribute to it.Report

Between the comments and the OP, Burt’s written a lot here. And without directly addressing any one particular point, it’s important to note that Burt is right at the meta level about one important thing.

There is no unilateral action by the Executive Branch which resolves the problem without one or more of, causing substantial adverse disruption of the markets, including Treasury auctions. Or directly causing economic disruption. Or (and this has for the most part been ignored), not being able to generate enough revenue to fund the government operations on a stable basis.

Eg, things like a premium bond or the trillion dollar coin are actually not bad ideas, _if_ it’s a matter of keeping the trains from derailing while Biden and Kevin McCarthy hammer out something for the long term. The problem for libs is, even if such things “work”, they don’t work for long and for that reason they don’t mitigate the GOP’s leverage with the debt limit.

A lot of libs have, in their own minds, believed that such things are questionably legal, so if the comeuppance comes, it will have to be from the Supreme Court. Eg, Biden invokes the 14th Amendment, and unless and until SCOTUS says he can’t everything is kosher.

But that’s not true. The Supreme Court is only one of several parties who could throw monkey wrench in the libs plans, and probably not the most important ones.Report

While that’s true, the actual real reason that no one could use the trillion dollar coin is that either the Treasury or the Fed has possession of it, and aren’t going to spend it.

Only in the sense doing all this appears to be legal, in opposition to the extremely weird legal analysis that seemed to think commemorative coins aren’t legal tender (Which they explicitly are), or somehow aren’t legal tender until sold.(1)

1) Which in addition to that interpretation being completely unsupported by law, how on earth is that supposed to work? How are we supposed to know if any coin we use as tender has been ‘sold to the public’ or not, and thus is legal? Hell, how can _the Mint_ tell…coins do not have serial numbers!Report

Also, again, while the ‘sold the public’ has absolutely no backing I can see, there actually is an incredibly obvious way around that hypothetical objection: Create a non-profit, have the Fed loan it a trillion dollars to buy the coin, have it buy the coin with that money, have it repay that loan to the Fed _with_ the coin. Tada!

Like, this is so inherently stupid an objection that the fact such a concept doesn’t exist in the law makes you miss that even if it did, it’s no objection at all. The premise is literally that The Mint mints a trillion dollar coin _and then sells it_ to the Fed. Pretty sure they can figure out a way to sell it to ‘the public’ for a second before it ends up in the hands of The Fed. (This is assuming the Fed itself somehow doesn’t count under whatever law they’ve hallucinated applies.)Report

“Query, then, if calling a physical object “legal tender” has the significance either of us attribute to it.”

It depends on whether the flag in the courtroom has a gold fringe and whether your or not your birth certificate has the words “Panama Canal Zone” on it.Report

It seems to me that inflation is a measure of confidence in a currency. Minting that coin would devalue the currency by announcing that we don’t intend to support it or pay our debts. That’s bound to have inflationary effects.Report

…you think doing something to make it _so_ we can pay out debts is announcing that we don’t intend to pay our debts?

There’s exactly one political party announcing we’re not going to pay our debts, and they’ve announced it so hard and repeatedly that we had our credit rating downgraded int he past. And it’s not the Democrats.

If Biden is forced into this, it will indeed look back for our willingness to pay our debts, but that’s because, uh, Republicans are not willing to pay our debts and tried to blow up the economy.Report

“…you think doing something to make it _so_ we can pay out debts is announcing that we don’t intend to pay our debts?”

There’s paying the debts using wealth, and there’s paying the debts using a piece of paper with “THIS IS WORTH ONE MILLION BILLION US DOLLARS SIGNED JANET YELLEN” written on it.

You’re really gonna tell me those aren’t different?Report

That’s…not even vaguely how the plan works. Like, you know that, right? The plan is to mint the coin, sell it to the Fed for a trillion dollars, thus have a trillion dollars they can give to the people they owe money to.

Everyone who has debts from the US government would be paid exactly as before.Report

Would there be any bigger consequences if we minted a $4 trillion coin?Report

Yeah! I mean, this completely not serious guy wants us to only gin up one trillion! We’ll blow through that in a week!Report

I choose to spend an evening intimately with a gentleman in exchange for rock cocaine. It is a one-time event. Afterwards, I will analyze the choices that have led me here, and make any necessary reforms.Report

Chait comments in observing the odd behavior of the media on this subject.

https://nymag.com/intelligencer/2023/05/debt-ceiling-congress-blame-republicans-democrats-default-new-york-times.html

My own personal take is that the assorted elite “masters of the universe” set don’t love the risk of what the GOP is doing but would love to get some outcomes out of it that they’d like- to wit some kind of deficit reduction that isn’t paired with revenue increases. The main stream media is heavily influenced by these kinds of fishers and it’s leaning hard to BSDI this issue to the nines. You can also see the same thinking in all the business groups who’re studiously effecting neutrality and are urging a “compromise” with the the GOP on this hostage taking. The short sightedness is infuriating.

If the debt ceiling isn’t a deal law walking now, it’ll soon be if the so called “moderates” keep pushing it this way. It’s survived this long by being something both sides could jaw about but that wasn’t a concrete threat. If it becomes a periodic republican extortion mechanism, as it rapidly is becoming, then the next time the Dems have the trifecta it’ll be gone, and rightly so. It only survived the last cycle by the skin of two Senators teeth and neither of them are long for the Senate. That is, assuming, that Biden doesn’t call their bluff and blow through it.Report

Ahh, Jonathan Chait. I wonder what his latest column is about? Heh.Report

Well if you didn’t read it, it’s about the media’s odd enabling of the GOP’s duplicity and hypocrisy on the debt ceiling. Chat does his normal excellent job of taking them to the woodshed, his writing is strongest when he’s tilting at that sort of stuff.Report

Nah, I was just laughing that all of his columns are about the same thing.Report

Heh, clearly you are very unfamiliar with Chait’s writing if you think that.Report

Chait is right, and it’s lazy ‘view from nowhere’ journalism to portray the Democrats as having any sort of culpability in this.Report

That or a subtle elite libertarian sentiment masquerading as high minded non-partisan analysis. Probably both depending on the talking head in question.Report

Chait and you are both wrong. Demos have all the culpability for this.

You gotta play the ball where it lies. At some level, it’s reasonable to think that a golf course with a debt ceiling on it is a stupid course. But that’s not important right now, more importantly it’s not anything in your capacity to change. So pull a club out of your bag and figure something out.Report

I agree, in this case the correct play is refuse to pay a ransom and then when the markets finally begin to panic force through the discharge petition or, if that doesn’t work, continue issuing debt and take it to court so this matter is resolved for good. Paying the ransom is ludicrous and will only guarantee future ransom demands. Trying to bargain on the debt ceiling was one of Obama’s worst decisions as president even if he came at it from a high minded position.Report

Heh, as if.

When and if the panic does set in, I can tell you it’s not going to be the GOP’s who back down.

Push comes to shove, I’d still say it’s more likely than not that we’ll have a deal. But that’s by no means a certainty. If you and the people who and the people in Washington who in some ways are positioned “like” you who in a week or two still think the same way as you do now, we _are_ going over Niagara Falls. I am convinced of that.

In terms of a clean or clean-ish debt limit passing the House, it’s not just that McCarthy doesn’t favor that. There’s not one solitary vote in the GOP caucus in favor that. Moreover, there isn’t even the prospect of one GOP vote in favor of that anywhere across the distant horizon.

No, Demos and Joe Biden are going to cave to get out of this jam.Report

Of course the GOP won’t back down – because they have convinced themselves it won’t hurt them economically or politically. They don’t think a collapse will cause China to ascend further. They don’t think they retirement accounts will be wiped out. They don’t think any of their businesses will close.

They also don’t care that all these things will descimate their base, alienating them even more.Report

No, not at all. GOP knows perfectly well the possibilities for many adverse outcomes, if the debt ceiling isn’t raised.

And in that world that’s where they (and me for that matter) have decided to try to hold its line.

If you really really want to try us, we’re here.Report

So burn it all down to get our way. How patriotic of you.

How about your side admit the Two Santa clauses approach set us up for this? How about you all take credit for ballooning the debt with tax cuts? How about you all queue up honestly about wanting to trash social security and Medicare in favor of the military spending.

Or just keep expecting Democrats to save yourself from your own craven desires. One of these days – perhaps now – we won’t anymore.Report

True, it’s potentially going to be grueling and knowing what we know now it’s clear that it’ll be a tough fight because the purported non-partisan elements are going to be pushing hard to try and force Biden to back down and give in to the GOP’s over the top ransom demands. I think Biden honestly thought the business interests and “non-partisan” agents would acknowledge which side is precipitating this crisis and help convince the GOP their demands wouldn’t fly but that clearly was a miscalculation on his part. The real question is if Biden doesn’t blink when the business interests will do so and yank the leash on their pet centrist GOP congresscritters to pass a clean debt limit increase, the discharge petition would only need 5 votes to move it along.Report

A discharge petition is the solution to a different problem. A discharge petition is a for a situation where you have a presumably bipartisan working majority in the House for this or that that does not include the Leadership. Then, if the stars line up right, you can use a discharge petition to get a bill out of committee and onto the floor and presumably from there to a final vote.

Here, there is no working majority for anything the Demos want, or anything remotely close to it. The members are solid behind the Leadership.

From your pov, it’s better and easier to just assume that discharge petitions don’t exist. The fact that they do exist doesn’t change anything in any meaningful way.

If Biden doesn’t blink, we are going over Niagara Falls.Report

so your side believes this is important enough to hand China economic victory?Report

If there is economic turmoil as a consequence of the debt limit issue, and if as a consequence of the economic turmoil that China can opportunistically advance its interest to the detriment of ours, then we have yet another example of foreign policy incompetence from the Biden Administration.

And if I’m guessing right, Kevin McCarthy is probably telling President Biden this to his face as I write.Report

Not if McCarthy wants to ever actually govern again.Report

As if our Kevin ever had delusions of governing.Report

Kevin may not have delusions of governing, but the GOP does. And IF they manage to retake the WH and the Senate, they they would have to clean up whatever messes they make on the way there. Their handlers will demand no less.

A default mess, unfortunately, won’t be easy to clean up.

And while the T-bills China holds might indeed tank as a result of a default, China will then be in a place to claim honestly that such a thing would never happen in their sphere and so non-aligned nations need to keep flocking to them. It might hit them economically, but they might well come out ahead in foreign policy. And it would be another thing a Republican run nation wouldn’t easily be able to overcome.Report

I doubt China would much enjoy this kind of mess any more than any other major holder of T-bills does.Report

Based on your analysis I’d say Biden’s only realistic option is to not blink. The GOP ain’t offering him any other option but to pull the trigger now. Anything he gives them will just get pocketed and then they’ll come back to extort him again.

The discharge petition is useless, currently, agreed. But it sits there offering a ready and prompt offramp the moment that five republican congresscritters get spooked by what their wingers (And Kevin who’s on those wingers leashes) are getting them into.

But at the moment it does appear to be a case of chicken. I just don’t see any plausible reason why BIden and the Dems should blink first. If Biden wins, this nonsense will be done with and if the GOP wants to play at being deficit hawks they can do so where deficit hawkery belongs- in the budget (which, I note, they haven’t passed anything on). If the GOP wins then we’ll be back at this same mess the next time the debt ceiling approaches.Report

This is exactly it. If Biden gives in, he’s done for politically.

If he doesn’t, and R’s really are willing to hold the line, then what the hell does he care? The guy’s nearly 80 years old.Report

No, it will probably be work requirements for social insurance programs, discretionary spending caps and changes to IRS policy. That’s what Biden and McCarthy are talking about now.

It’ll hurt the libs, but nothing they can’t realistically give on.

It’s not, though, that’s just it. By far the best and quickest way to a deal as an agreement between President Biden and Speaker McCarthy (That’s another point Liam Donovan has been harping on btw).

If somehow you had five Republicans and 213 Democrats all signed on to a discharge petition, then this plan goes from the impossible to theoretically possible. (AFAIK there aren’t 213 Demo signatures on any discharge petition btw). But even allowing for that, that’s only the beginning of umpteen rounds of legislative japery.

The GOP asks are far more doable, especially once they’ve been boiled down to something like what I wrote earlier. Which btw, is as good a guess as any as to where it ends up.Report

Work requirements on social insurance already exist, and have since … checks notes … 1996 or so. So there’s no reason for Democrats to give in to that.

Discretionary spending caps technically exist – and would be easier to think of as an actual demand if the House had done its job and passed a budget resolution already for this year – which is the first step in an appropriations process. And given the GOP’s willingness to crash the Sequester, I don’t see any reason to take that on good faith either.

As to “IRS policy” – they only major change made recently is the IRS finally being able to staff up and go after rich tax cheats. I get why some GOp donors might not like that, but again, its not something the Democrats can really give away since its a done deal and it generate revenue in excess of cost, which no GOP tax cut has done in over 40 years.

Got any other vaporware we can laugh at?Report

Philip,

The more insignificant or more inconsequential you want to characterize the Republican asks as being, the easier it is for President Biden to give them.Report

They aren’t being serious. TANF work requirements? Already the law of the land. There’s nothing Biden can give them there. So its not an actual ask.

And please, discretionary spending caps are useless. Biden knows this, so why give something useless to people negotiating in bad faith?

And the IRS? That would be akin to Obama vetoing the ACA. Not gonna happen.

There’s no serious ask here to negotiate against.Report

Well the IRS policy one is especially laughable since it -increases- the deficit rather than decreasing it.

As for the discharge petition, sure the GOP could try and hold it up in the Senate but if they get to the point of breaking ranks it’s unlikely that cocaine Mitch would hold it up. They answer to their money men after all.

But I see little way that Biden can reach a deal. Heck, McCarthy has no proven ability to pass any compromise and, so far, all their asks have been ludicrously deranged.Report

I mean, this is the important point. McCarthy literally cannot provide any of this stuff. Why should anyone negotiate like he can?Report

Biden started off not doing so, and then all the talking heads dragooned him into it because it was either talk to Kevin even though he can’t deliver or not talk at all.Report

I think you’re understating things by quite a bit. One of the key developments over the last say, 4 to 6 weeks is that Wall Street, the nonpartisan deficit hawks, the Chamber of Commerce, etc, are perfectly fine with getting together with the Republicans in the House and putting Biden over a barrel to extract some budget cuts and policy changes in return for lifting the debt ceiling.

There will never be another Demo trifecta again in our lifetimes, with one major caveat.

If Trump wins the nomination, then Demos are going to win everything remotely plausible and a few things that aren’t. In 2024 and probably a couple cycles after that. Eg, recently I think Sean Trende has tweeted that Sen Ted Cruz and the GOP Presidential ticket in Texas are at least small underdogs, and there’s been some people pearl clutching over that.

But if Trump is the nominee, I don’t think that’s the least bit outlandish. (if he is not the nominee, that’s ridiculous.)Report

Koz, my buddy, you’ve been assuring me the Dems are doomed and will never be elected again since, what, before Obama’s landslide? And then, in your second breath, you add that if Trump is nominated (which seems a not at all unlikely proposition at this point) then the Dems will win it all. Frankly that’s a shocking climb down from you.

I agree that a lot of ostensibly non-partisan business and media figures are showing their cards with their behavior on this matter and that, going forward, anyone who believes them to be non-partisan should correct their thinking on the matter and recognize them as merely disguised fiscal republicans and treat them accordingly.Report

Yeah, I’ve changed my mind on quite a few things, that’s one.

That’s just not gonna fly, because they really are nonpartisan.

But as far as this goes, they’re with us and if the pressure continues to escalate, it’s more likely to fall on you than us.Report

Nonpartisan how? If they ignore GOP spending when the GOP is in power and then help back up these nutty ransom demands when the GOP is out of power how does that differentiate them from a standard GOP talking head?Report

The Demos (and others) vaguely thought there was too much federal government spending under the Trump Administration. But they never really tried to fight any of it. They had other priorities, and there wasn’t anything in particular they wanted to cut for fiscal reasons.

The deficit hawks didn’t have anything to latch onto, and were basically out in the cold. That’s not the case here obv.Report

The deficit hawks only get hawkish when they think they can cut social programs or the regulatory state.

Change my mind.Report

I agree it is an old strategy of theirs. Republicans only try to cut spending when they think they can force a Democratic administration to do it for them. But by that understanding that defines said talking heads and groups as partisan republitarians. So they should be treated as such.Report

This is stupid. The Committe for a Responsible Federal Budget, and people like them, are advocacy groups.

If the members of the opposition party of the legislature aren’t fighting over spending levels, it’s not like they’re going to have more leverage working with anybody else.Report

If they’re only going to care about the deficit when the GOP is out of power, which has been their behavior to date, then they should be treated as partisan actors by all involved.Report

Making a claim about what will happen in the future and something else happening is not called ‘changing your mind’, it’s called ‘being wrong’.Report

There’s obviously a lot of words here, and by the grace of God I might comment on them at least at some modicum of depth. But for now, let’s note that the reason that the reason we’re having this particular problem at the moment is that liberals are bad people.Report

Specifically, Joe Biden has known since whenever this was going to come up, and for months he’s been fronting us, “We’re too cool to negotiate with Republicans, gotta go eat ice cream.”

Well guess what, he’s not that cool after all. He’s not, the libs are not, the Demos are not, and in all likelihood the President and the Democrats in Congress are going to have to pay a lot more to get out of this jam than they would if they were good faith actors back in January/February or some other reasonable time.Report

Conversely, how do you negotiate with someone who points a gun at his head and says, “Stop, or I’ll shoot.”?Report

Very easily. Pay him what he wants. And reading the tea leaves, it doesn’t look like the ransom is that much.

(Frankly, this part of the whole drama is the silliest imo.)Report

That’s like the parent who buys the kid a candy bar in the checkout aisle to get him to shut up. Both people learn a lesson, but one really regrets it.Report

Libs think it’s like that, but in reality it’s not. In the real world, the debt ceiling is a real thing. It creates a real veto point, and GOP is exploiting that veto point to win real concessions.

The sooner we all get on the same page for this, the happier we’ll all be.Report

That candy bar is pretty real, too.Report

Yeah, but no.

The debt ceiling is real. What’s fake is the idea that Mommy can grab the candy bar out of the kid’s hand and put it back if she’s willing to listen to the kid cry in the car on the way home.Report

So they want to veto spending and tax cuts they previously supported. That’s . . . interesting.Report

So, Koz, would you say the Dems missed an opportunity when they raised the debt ceiling for multiple republican Presidents without extorting concessions? Or is this yet another area where it’s only okay when Republicans are doing it?Report

Bingo.Report

They didn’t, see Liam Donovan about that in general.

twitter.com/LPDonovan/status/1654532789448867842

But frankly whether they did or didn’t doesn’t change where the Demos are now.Report

Oh tosh, they weren’t demanding that Trump pass huge tax increases or other unpopular reversals of the tiny number of Trumps accomplishments in office.

Donovan is trying to obfuscate by observing that occasionally the limit got other things lumped in with it but the Dems have never threatened to blow up the debt limit if they didn’t get things the GOP was absolutely opposed to giving. There’s no left wing equivalent of the hostage taking the GOP has been doing.Report

To Wit:

https://www.msnbc.com/rachel-maddow-show/maddowblog/weak-case-blaming-dems-gops-debt-ceiling-crisis-rcna85822Report

The Republicans aren’t either, except for the fact that Biden played his cards the particular way that got us to here.

If Biden had been picking off stray Republicans here or there since December or January or whatever, things would be a lot better for him now.

Instead, the President has been fronting us for six months, so the House GOP passed the LSGA. And among the provisions of the LSGA is the repeal of the IRA, the last gasp of the Covid stiumulus and all the money that they armtwisted Joe Manchin to sign off on.

Even now, it’s very unlikely that IRA will be repealed as part of the debt limit increase, but the only reason it ever got into play in the first place was because the Demos put it there.Report

Umm, like you said, the GOP didn’t even have a list of demands (not even as vague and vacuous as the LSGA is) until they, barely, passed one last month so Biden did the only thing he could do which was state his position that the GOP should raise the debt ceiling for him, just as the Dems raised the debt ceiling for Trump and W before him.

And, certainly, there were no republican congresscritters to “pick off” earlier.Report

Of course it wasn’t the only thing Biden could do, that’s the whole point.

There was nothing preventing BIden from talking to Republicans, individually or in groups, to figure out what it would take to get some of them to raise the debt limit.

But the libnasties on Twitter said, “Clean lift or nothing!” and talked Biden into that. And so here we are.

The upshot of this is, Biden is (and the Demos) are going to have to sign off on work requirements for TANF and the like. And nobody is going to believe them when and if they say they can’t.Report

https://www.acf.hhs.gov/opre/report/tanf-work-requirements-and-state-strategies-fulfill-them

There’s no there there Koz.Report

Are you familiar with TANF work requirements? I’m not, so I just started looking into them, and apparently states are responsible for achieving an all-families work participation rate of 50%, but that includes something called caseload reduction credits, which look to run about…50%. I know nothing about this field so I could be reading things wrong, but it looks like the US rate is actually 18.8%.

https://www.acf.hhs.gov/ofa/data/work-participation-rates-fiscal-year-2021Report

If you think Biden and his minions weren’t back chanelling every GOP congresscritter on this matter from the get go you must not have been paying attention. That’s how they got the chips act through to the surprise of everyone. They probably still are, but I expect the markets are going to need to freak out and the wealthy powers behind the GOP are gonna need to get spooked before any of them GOP congresscritters break ranks.Report

You have to remember dear North that Koz doesn’t believe Democrats or liberals are Real Americans, and so we must be kicked constantly. He’s also dealing the with cognitive dissonance of the near shellacking of the GOP in last year’s election and the fact that Trump is likely the nominee for next year even though he’ll be on trial in Manhattan.

Makes analysis tough.Report

They weren’t, that’s exactly what I’m telling you.

Read the dispatches from the NYT, WaPo or the like if you don’t believe me.

If Biden and the White House handled the debt ceiling the same way they handled the Chips Act, specifically as it pertains to relations with Congress and Congressional Republicans, we’d be in a much much different place now.Report

Fixed it for ya.Report

Oh, and as far as breaking ranks goes, I’d be looking at your side before ours.

You think when Janet Yellen figures out that work requirements and spending caps are the holdup to a debt limit deal, you think she’s

going to be like “Yep, I’m gonna get started building that coin right away Mr President.”

No, she’s gonna say, “Take the deal, Mr President, while it’s there and before I go on television to tell you again to take the deal.”Report

There’s a lot more GOP congresscritters with very complicated interests involved than there are actors on the Democratic side. I’m certainly very dubious that it’d be Yellen.

And, I note with interest, that you’re only mentioning a tiny amount of the demands the GOP has made on raising the debt ceiling.Report

O rly? You hear any Executive Branch people who sound like DavidTC on this thread? I don’t. All that stuff comes from Twitter and the comment section of the League.

They know perfectly well enough that whatever is on offer from the Republicans is miles better than the 14th Amendment or the trillion dollar coin or some other brainstorm. Push comes to shove you think they’re supposed to shut up because they have to stay tight with President Biden, and he has to stay tight with Mehdi Hasan?

It could be, but maybe not. It’s at least as likely they’ll think the whole thing is a teachable moment where they get to square away some libs as to a fact or two in the real world.

And, even if you are right, it probably wouldn’t make any difference. GOP has enough leverage to make their play as it is.Report